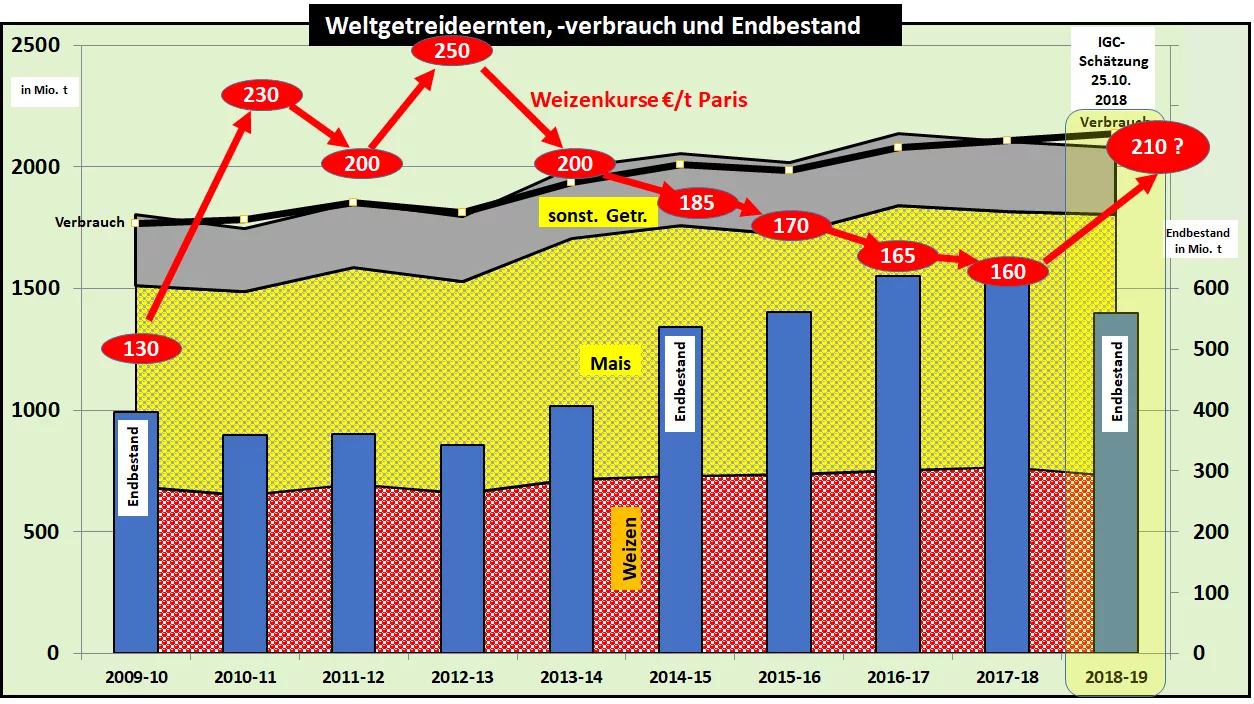

IGC: More wheat, corn unchanged; EU-COM: further reduction of the EU harvest 2018 At the end of October 2018, the International Grains Council (IGC) and the EU Commission (EU-COM) published updated estimates for the harvest results 2018/19. The IGC estimates that global wheat harvests are 12 million tonnes higher, and the corn harvest is still the same month-on-month. At the end of the year, global cereal stocks are expected to be somewhat higher than previously assumed at 560 million tonnes, but will remain just under 10% below the previous year.The higher global wheat harvest comes from greater than previously estimated results in China (+ 12 million tons), Russia (+ 1 million tons) and the Ukraine +1 million tons. In contrast, the wheat-generation was the IGC because of the drought in Australia t to +2.5 million and in Argentina by +0.5 million tons reduced to the previous month. Global wheat consumption was estimated slightly higher. Compared with the previous year , wheat stocks are expected to be 11 million tonnes lower . The drop of 17 million tonnes is particularly strong in the major exporting countries with a focus on the EU.On the other hand, the large inventory increases in China do not play a price-determining role because the country does not participate significantly in world trade. Black Sea exports are down year-on-year at -22% on an annualized basis. For the time being, however, high Russian exports are expected by the end of 2018. As a result of the onset of winter, Russian deliveries are expected to be much smaller in the new year . There are also export cuts in Australia and Argentina. The expected smaller export supply in spring 2019 should at least strengthen or even raise international wheat prices. Due to the lead time for reporting, the IGC figures are already being overtaken by new reports .According to official reports, the Russian wheat harvest should be slightly higher than the IGC has estimated. By contrast, more than 50% smaller harvests are expected in Australia due to drought, as measured by the 20-year average. Australia's usual 50% export quota will be noticeably lower in the spring of 2019. The IGC estimates that global corn yields still outstanding or still outstanding will amount to 1,074 million tonnes, unchanged from the previous month. Compared to the previous year , earnings increased by 2.5%. High production growth of + 5% is anticipated in early summer 2019 in South America. With rising industrial and feed consumption , the maize end stocks according to the IGC calculations by approx. 14% back.Overall, the grain year 2018/19 is characterized by a tighter supply situation compared to the 3 to 4 years before. Ongoing global production is below consumption. The Russian harvest is 17%, the EU harvest 7.5% below the previous year . The US crop alone is 2% larger. Global inventories are significantly reduced. The price-determining final stocks of the 8 major export countries fall by approx. 20%. The EU's latest EU crop forecast has now been revised down to 282.7 million tonnes. The 5-year average is 310 million t. The result for wheat is currently graded at 136.1 million. The final crop level amounts to 41.3 million tonnes or 11 million tonnes less than in the previous year. Imports rise to 23.8 milliont and exports only reach 32 million t. The more than twice as high EU export surpluses of earlier years are over for the time being.