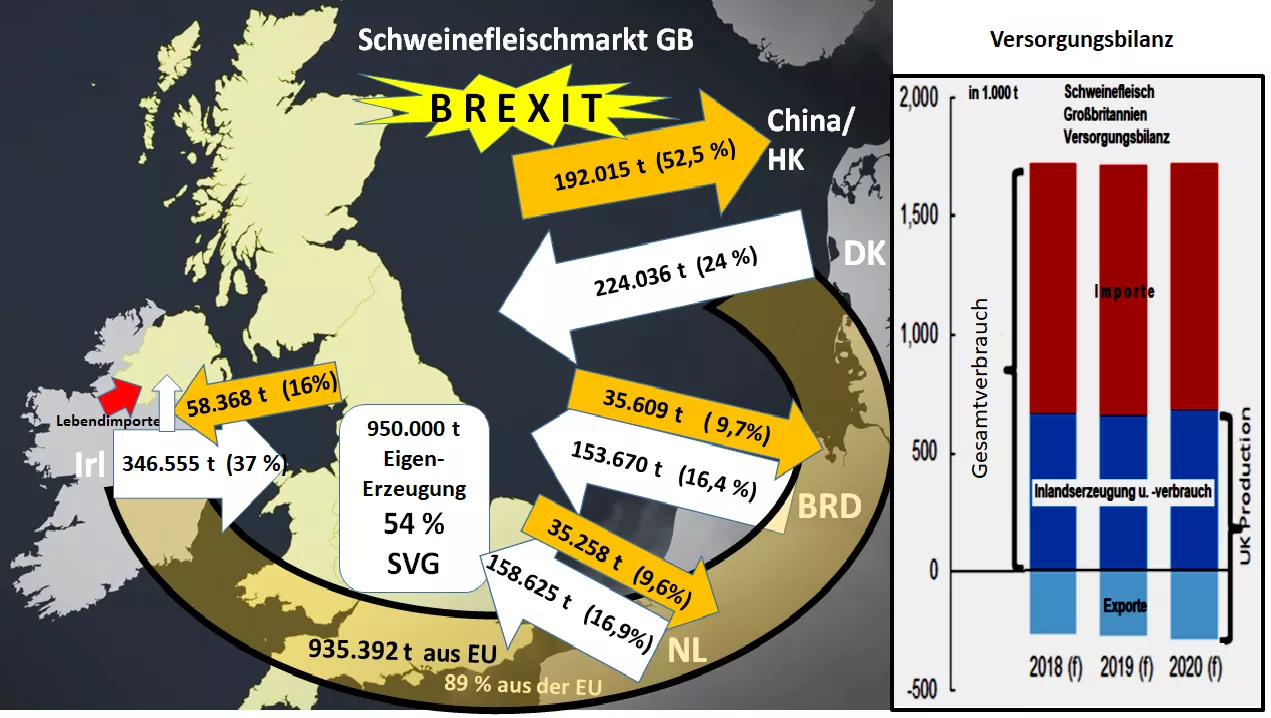

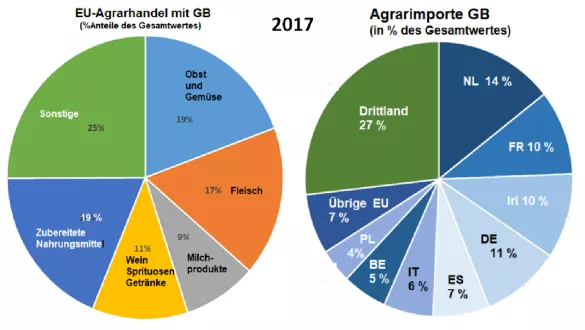

What happens in the pork market when Brexit comes in 3 months? With British Prime Minister Johnson, the likelihood of a hard Brexit is growing. Although not everything is eaten as hot as it is cooked. It's going to be pretty dramatic anyway. For the pork sector, there is a high degree of interdependence between the UK and the exporting countries Ireland, Denmark, the Netherlands and Germany. Other countries are less affected. Firstly, it should be noted that the United Kingdom only has a self-sufficiency rate of around 55% for pork. The import requirement is approx. 1 million t per year. Of these, the EU Member States have so far provided approx. 935,000 t or 89%. Ireland accounts for a good one third of this share. The Irish export half pig pork and half processed pork as well as by-products. A special relationship exists with Northern Ireland with the deliveries of live pigs for the local abattoirs.The threatening specter of a future hard border should be prevented with the contract clause "back stop" (= no relapse into old times), but meets with the Brexiteers on deaf ears. The Danes provide a quarter share. In addition to the usual pork, this includes, in particular, the traditional Bacon meat . The Danes have always been able to meet British demands for eco-keeping and litter with branded meat programs and can secure a stable market share. The Netherlands has a share of approx. 17% also with bacon meat, sausages and usual cuts in the shop. For the bacon production extra piglets are imported from Denmark. Germany exports from the North German processing areas approx. 45,000 t pork, just under 20,000 t of processed goods and 41,000 t of sausages of all kinds. German sausage enjoys a special appreciation in Great Britain. Measured in terms of the overall German market, the British share of approx. 100,000 tons or2% comparatively little, but the market volume hits in particular the North German area and it lacks the last sales volumes, which make up the price. In the case of a tough Brexit, Britain would become a third country with corresponding application of high WTO tariffs in the order of up to € 0.85 / kg. The British import would react immediately with smaller purchase quantities. The bigger problem is that the other EU exporters face the same problem. It follows that the sales congestion in the direction of Great Britain is shifting towards a delivery of goods towards the continent . Germany is the nearest address with corresponding consequences for the prices. On the other hand, the British have a big supply problem . British pig farmers are already counting on doubling pig prices. Should a significant increase in pork prices occur on the island, tariff-ridden imports could have a relatively smaller impact on sales. It remains exciting.