Rabobank: weak dairy prices in the second half of 2014 - CME courses stable

Since Feb 2014 permanent decline in global milk prices - measured on the GDT auction results will won't reverse, says Rabobank contrary to earlier expressed expectations.

The reasons are both delivered on the offer such as demand side:

The currently observed increase in milk production in all major production areas will but not very much fade while something. On the demand side, the restrained demand of China's eye-popping stands out. According to the Rabobank China has himself supplied so much milk product imports in the first half of the year, now emerged a certain surplus. At the same time the own Chinese production has increased significantly. On the demand side, persistently high consumer prices for slower income growth develop a less strongly rising consumption development. All of these factors contributed to the price declines in the first half of the year, so the Rabobank.

In the second half of to while moderating the increase in milk production in the production areas, but are still clearly felt. China will melt off its accumulated inventories by decreasing import purchases. In the remaining areas of consumption, putting on earnings - and price-induced increases in demand in moderate frame.

For the EU-28 Rabobank is increasing production in the first after a 5.6% half of that production will move above the increase in consumption. EU exports will slow down significantly. This means price pressures.

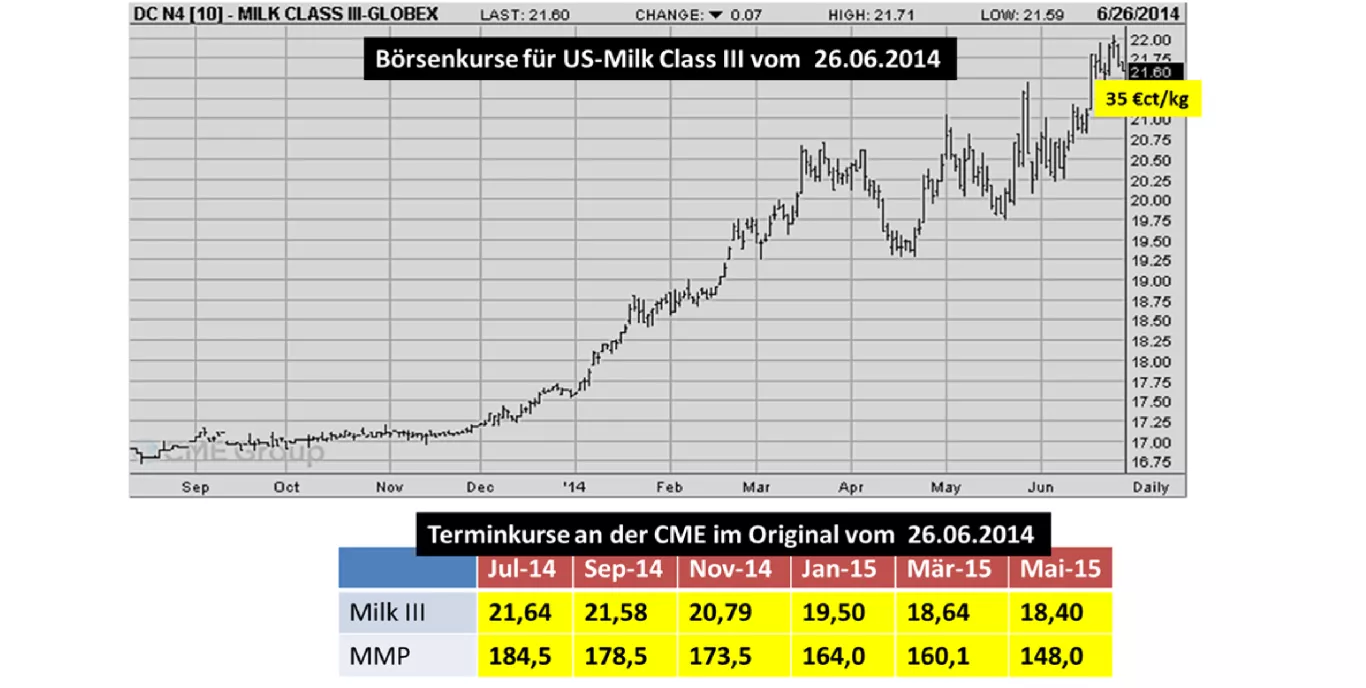

For the United States, the Rabobank sees a looming price decrease, which is also documented in the forward quotations of the second half on the stock exchanges.

New Zealand Milk production will once again put in the new campaign beginning from August 2014 and to settle above the level of the year 2013. Correspondingly high are estimated the export deals.

For Australia the conditions for increasing milk production currently don't look bad. But it threatens the weather anomaly El Nino, which in particular concentrated dairy in southeastern Australia to create could make.

Brazil Dairy farming goes first in the seasonal drought. The highlight of the milk delivery is in December. Level of production rises. the Rabobank assumes that the increasing production in their own and neighbouring countries remains.

The Argentine dairy industry suffers from the high inflation rate. Milk production is declining at least until the end of 2014. Should El Nino weather anomaly occur, excessive rainfall will make the turn of the year and then even more difficulties dairy farmers.

Decreasing Chinese milk supplies, relaxation in other dairy production areas and if necessary. a weather-related production decline in El Nino should cause at the earliest at the beginning of the year 2015 rising milk prices, the Rabobank says.

The listings on the CME for milk and milk products of various kinds 2014 indicate comparatively stable price developments for the rest of the time. Falling prices are expected in the spring of 2015.