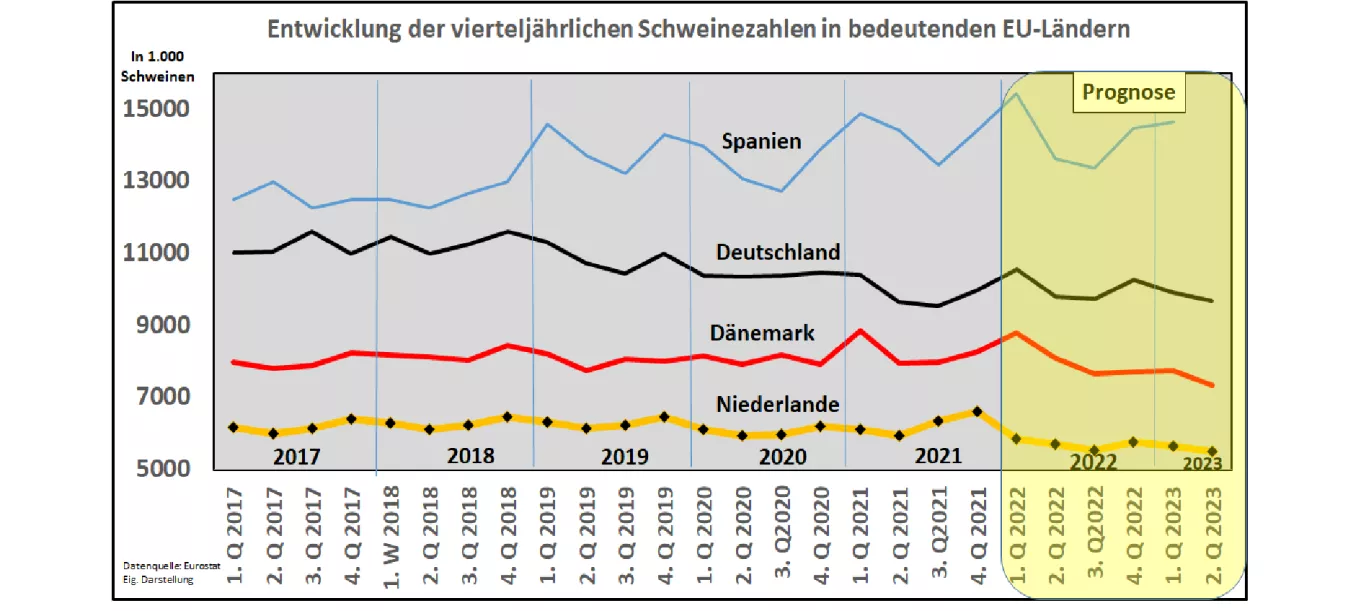

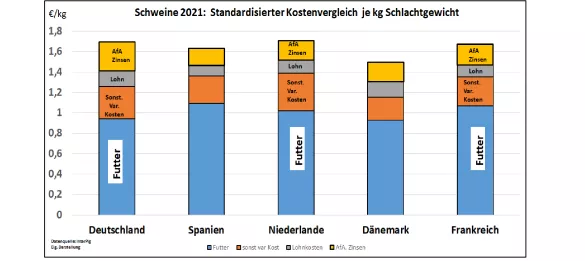

Status and prospects of pig farming in important EU Member States With the exception of Spain, pig production in important EU Member States shows a clear decline for the years 2022 and 2023 . In Germany , the decline in stocks that has been evident for years is continuing. In Denmark and the Netherlands , after an interim high phase in 2021, a current and future downward trend can be observed due to the China business. In Spain , on the other hand, the increase in production that has been going on for years is being slowed down a little. The current driving forces behind this development are the increased feed and energy costs, which can only be translated into higher pig prices to an insufficient extent. High inflation rates and reduced consumer income purchasing power reduce demand. The losses that have occurred so far and the little prospect of economic viability for the near future are leading to a trend toward declining animal populations.The production costs per kg slaughter weight differ in the individual EU member states. Feed costs account for the largest proportion of the total costs, but the other expenses can have a cost-enhancing or -mitigating effect. Due to its permanent undersupply of fodder, Spain generally has higher fodder costs despite comparatively cheaper fodder conversion, but achieves a competitive advantage over its competitors thanks to low construction, wage and environmental costs. In Denmark , the production costs per kg slaughter weight are comparatively low. High productivity in rearing and fattening are the main reason. Nevertheless, Danish pork production is limited in terms of area due to the high pig density achieved. A year-long switch to less environmentally harmful piglet production for export purposes has largely been exhausted. Similar limiting area ratios also apply to the Netherlands , which has also led to increased piglet production for export purposes.However, the construction and environmental costs in Holland are comparatively higher. Germany still had cheap feed costs in 2021. But the other cost items for barn, labor and environment have completely offset this advantage. Significantly higher feed and energy costs can be expected in 2022 . The level of effort per kg slaughter weight increases. Corresponding increases in revenue are not in sight, however. The ranking of the production areas will change depending on the different initial conditions and adjustment responses.