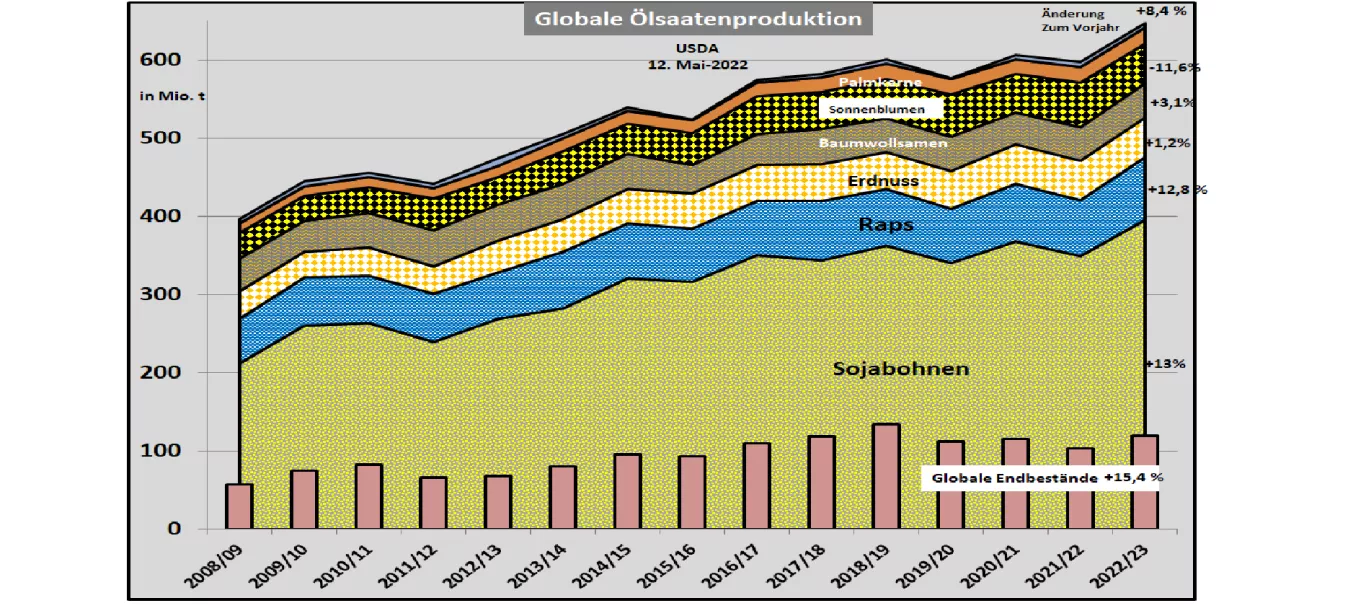

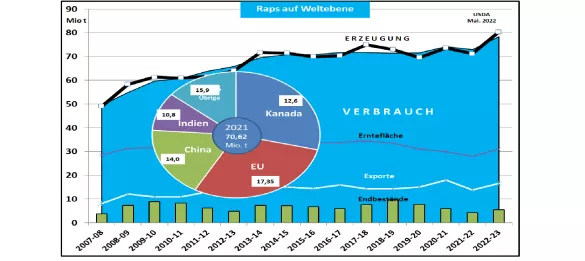

USDA estimates oilseed supply higher in 2022/23. In its May 22 estimate, the US Department of Agriculture (USDA) significantly increased the new oilseed crop 2022/23 to around 647 million t (previous year 597 million t). Consumption is also estimated to be higher at 631 million t (previous year 609 million t). The ending stock increases to 119 million t . Mathematically, the inventories are sufficient for 69 days (previous year: 62 days). The decisive increase is due to the increased harvest in the soybean sector with 395 million t (previous year 349 million t). The global rapeseed harvest is also estimated to be higher than last year's 71 to 80.3 million t this year. On the other hand, because of the war in the Ukraine, sunflower seed has fallen by 7 million t to just 50 million t. The soybean market is dominated by the 3 major production areas: Brazil with 149 million t (previous year 125 million t), USA with 126.3 milliont (previous year 120.7 million t) and Argentina approx . 51 million t (previous year 42 million t) minted. The South American harvests will not take place until spring 2023. When it comes to soybean exports , Brazil is still in first place with an increased volume of 88.5 million tons. In addition, there are almost 17.5 million tons of soybean meal. The USA expects an increase in bean exports to almost 59 million tons in 2022/23. US soybean meal exports change only slightly to 13 million tons. In addition to 4.7 million tons of beans, Argentina mainly exports 28.5 million tons of soybean meal and almost 6 million tons of soybean oil. On the import side , China is at the forefront with 99 million tons of soybeans (previous year 92 million tons) or around 60% of world trade. The reduced Chinese pig population has slowed down the previously customary annual import growth of 3 to 5 million tons.The EU-27 has been importing 15 million t of beans and 16.6 million t of soybean meal with little modification for a number of years. The USDA estimates global rapeseed production to be significantly higher at 80 million t (previous year 71.2 million t). The decisive factor is the Canadian rapeseed harvest, which is expected to increase to 20 million t (previous year 12.5 million t) after the heat in the previous year. Canadian rapeseed exports are also set to increase again to 8.8 million tons . In the EU , the rapeseed harvest is estimated to be +1.3 million t higher at 18.5 million t . Due to the global shortage of rapeseed, the EU import requirement is downgraded to just under 5.3 million t . Imports of rapeseed from Ukraine have stopped as a result of the war. The full effects will only be felt in the coming fiscal year. In the case of the other oilseeds, the declining production of 19 million tonnes of sunflower seed is significant.Production focuses on the Ukraine (4.1 million t) and Russia (5.6 million t) with a share of almost 60% of oil production. Around 75 to 80% of this is exported . However, the war in Ukraine will affect production and exports by an unknown amount. The USDA estimates palm oil production in the two main growing areas to be higher again. Indonesia in particular is expected to serve the market with increasing exports. Although palm oil prices have softened somewhat, they remain at a high level of over €1,500/t. Soybean prices have risen significantly on the Chicago Stock Exchange. However, the rapeseed prices in Paris (around €850/t) and Winnipeg (€800/t) show little change.