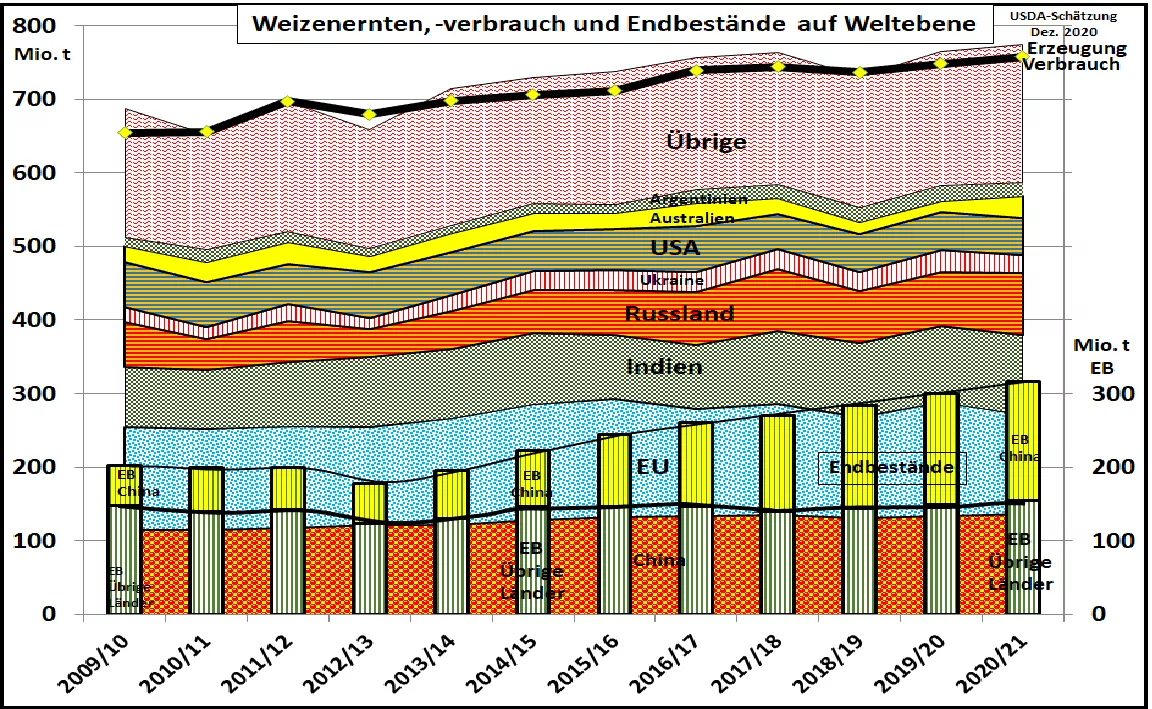

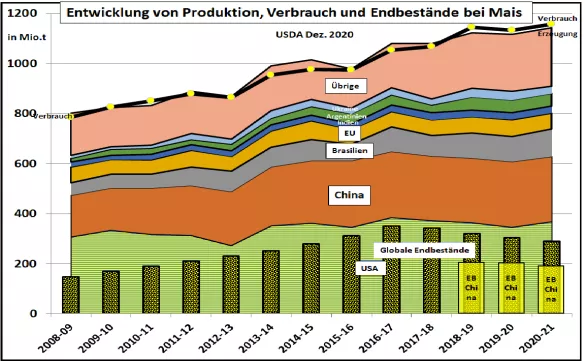

USDA: global grain supply situation: wheat rising, corn falling In its December issue, the US Department of Agriculture revised the global grain harvest upwards slightly in 2020/21 . But consumption was also increased. In the end, the stocks are classified lower. Measured against the global number of supplies, the security of supply drops only slightly from 29% to 28.6% of the final level of consumption . If you exclude China because of minimal exports but high stocks, the supply figure drops more significantly from 19.2% last year to 15.85%. Tighter supply figures provide decisive signals for pricing. For a differentiated analysis, a separate consideration of the two largest grain areas, wheat and maize, is useful. The USDA has increased global wheat production again due to the high harvests in Australia and Russia.Increasing consumption figures, with a focus on China, result in a reduction in final stocks compared to earlier estimates. Compared to previous years, however, the supply figure has improved from 23.8 to 24.9% (excluding China). China is reducing its stocks more than the rest of the world. The increasing import volumes from China are therefore noteworthy at 8.5 million t. Two years ago imports were only 3.1 million t. The trade dispute between Australia, with its high export potential, and China, with its increasing import demand, is of importance in terms of price policy. In the corn sector with the largest market share, the USDA made only minor corrections to the previous month's estimates for this year's harvest. In this case, too, the inventory reduction initiated in previous years will be continued. The global supply figure fell from 2 years ago by approx. 28% to the current 25%. Conditions in China are developing in the same way as in the rest of the world, only at a higher level.Chinese corn imports have increased significantly from 4.5 million t to the current 16.5 million t in two years. The latest figures give reason for international pricing to stop the recent decline in prices. The record results of the wheat harvests in Australia, Canada and Russia are fading quite quickly against the background of rising imports from China , which have not been up for debate on this scale before. On the other hand, the supply situation is still far from critical bottlenecks. Therefore, fixed prices in the previous range can still be expected. The focus is on the outstanding corn harvests in South America, with a focus on Brazil and Argentina. The risk of drought due to the La Niña weather phenomenon plays a decisive role.