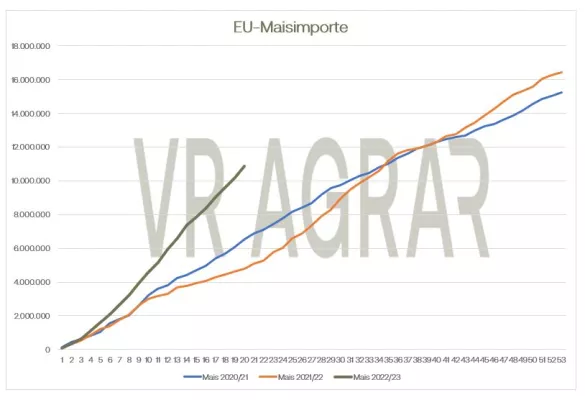

From this week's perspective, wheat prices on Euronext/Matif are falling. Yesterday there were green signs in front of the closing prices, but prices have been falling since last Friday. This is also reflected in the cash markets. Here the quotations have fallen much more clearly. Bread wheat delivered to Hamburg was quoted at EUR 338/t yesterday, Thursday. Feed wheat and feed barley are also showing lower prices than in the past week or at the beginning of November. The main reason for price pullbacks this week was the prospect of an extension of Ukraine's grain corridor across the Black Sea. According to plan, the previous agreement would have expired on Saturday tomorrow. Yesterday, Russia, Ukraine, mediated by the United Nations, and Turkey agreed to extend the agreement by 120 days. This put particular pressure on listings on the American CBoT. The rocket impact in a Polish village near the Ukrainian-Polish border also caused tension.However, the fact that, according to previous knowledge, it was a misguided missile from the Ukrainian air defense system only caused prices to rise for a short time. The association "German-Ukrainian Agricultural Policy Dialogue" announced this week that Ukraine has been able to export around 26 million tons of agricultural products since the beginning of the war. Including 5.4 million tons of wheat and 10.33 million tons of corn. With regard to sowing for the coming harvest, the association announced that winter crops were sown on an area of around 4.3 million hectares, of which around 3.6 million hectares were wheat. ‚ On the other side of the Atlantic, the drought in Argentina and the weak export figures compared to the previous year are shaping the market development. Overall, wheat prices on the CBoT also fell. The drought in Argentina prompted the International Grains Council this week to cut the outlook for global wheat production in the current 2022/23 season by 1 million tons from the previous estimate. The Argentine harvest is now expected by the IGC to be 13 million tons. Better harvests in Australia and Turkey can only partially compensate for these losses.Corn prices fell more sharply on the outlook and grain corridor extension. The front month of March 2023 on Euronext/Matif closed yesterday, Thursday, at a closing price of EUR 305.50. Last Friday, this contract closed the trading week with a closing price of EUR 320.00. On the CBot, on the other hand, corn prices rose despite the better prospects for the global corn supply situation due to the extension of the agreement. Yesterday, the USDA reported an export sale of 1.9 million tons to Mexico. At the same time, ethanol inventories have also fallen due to steady demand coupled with lower ethanol production. The EU maize imports have now reached a volume of 10.85 million tons. In the previous year, only 4.77 million tons of corn had been imported by mid-November. The high import figures are also reflected in the spot markets. Despite the small harvest in this country and the farmers' reluctance to sell it, the feed mixers currently seem to be sufficiently supplied with maize. The listings fell significantly both in southern Germany and in the north.

ZMP Live Expert Opinion

The extension of the grain agreement brings some calm to the market. The course of trading is therefore likely to increasingly focus on data relating to demand, harvest prospects and the development of inventories. Nothing will change at the high price level. Russia's war against Ukraine continues, the supply situation is tense. However, a new high is not in sight due to the delivery capacity of the Ukraine and the lush Russian harvest.