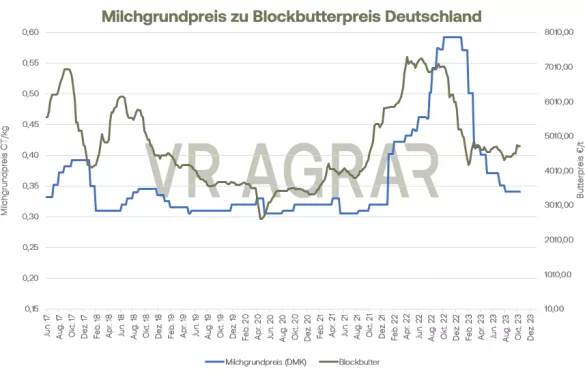

The quantities of milk delivered continue to decline. Compared to the previous week, around 0.4 percent less milk was recently delivered, but the quantity delivered is still around 0.5 percent above the value for the 39th calendar week of 2022. After the price increase from the end of September, the raw material markets are stable at the level reached. Demand for concentrates is described as good, with increased demand particularly from France and Italy. On the spot market, the national average price fell marginally to 43.0 cents (-0.1 cents/kg). Molded butter prices may increase significantly this week. The stock exchange in Kempten quoted a trading range of 5.00 – 5.34 euros/kg for branded butter. The dairies were able to negotiate and conclude higher selling prices for October. In the last week, the number of requests was slightly lower due to the holiday, but is already back to a high level. Consumer prices have risen to 1.45 euros for a 250 gram package, an increase of 6 cents. Organic butter currently costs 2.50 euros/250 grams. Block butter was also able to increase in price, even if the momentum here is not as great as with molded butter.Demand has increased due to declining milk deliveries and rising industrial cream prices. At the same time, many dairies have reduced butter production. However, the existing stocks ensure that there is no shortage. The butter and cheese exchange in Kempten increased the trading range by 5 cents to 4.65 to 4.80 euros/kg. The orders and demand for cheese continue to be brisk at the beginning of October. Promotions in the food retail sector have kept volumes at a high level. Industry and large consumers are also increasingly ordering goods, but these are within existing contracts. Slight impulses come from exports. The recent rise in world market prices has made German goods more competitive and the current euro-dollar ratio is also playing into the hands of European suppliers when it comes to exports. The prices in Hanover increased slightly. The prices for skimmed milk powder are also trending towards the north. Demand has continued to pick up and the seasonal decline in milk volumes and rising concentrate prices are now also affecting the powder market.Local manufacturers are also increasingly receiving inquiries from exports to third countries. Demand dynamics have increased, particularly from the Middle East and Northern Africa. However, demand from China falls short of expectations. Stocks are being reduced more and more. Prices on the EEX also increased on a weekly basis. Whole milk powder is also experiencing an increase in demand, spread across both short-term and later deliveries. The price in Kempten was able to increase at the upper end and is now at 3,440 to 3,580 euros/t. Firmer price trends are also evident for whey powder . The demand for short-term deliveries is largely unchanged; discussions are increasingly focusing on later delivery dates.

ZMP Live Expert Opinion

The stabilizing trends continued this week. Milk producers should be happy about this. The bullish arguments predominate.