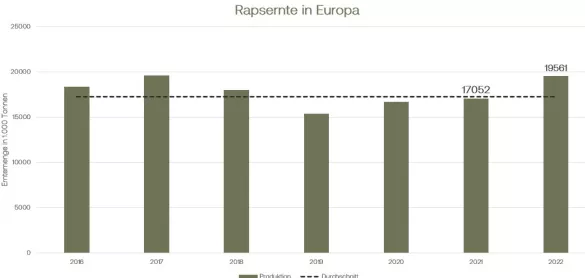

Rapeseed continued its downward trend this week. On Wednesday in particular, there were significant losses for oilseed. Closing last Friday The front month of February 2023 at 610.25 euros/t was yesterday, Thursday, still 586.50 euros per tonne on the Euronext/Matif display board. The follow-up contracts are also lower. Correspondingly, rapeseed prices on the spot markets also fell, in some cases significantly. The International Grain Council had recently increased its rapeseed forecast again. Compared to the previous year, more rapeseed quantities are available on the world market, mainly due to better harvests and Canada (+5.3 million tons) and Europe (+2.2 million tons). Above all for China, however, an increase in demand for rapeseed is also expected. For Australia, the Association of Australian Oilseed Processors renewed its forecast for a good Australian canola harvest last week. The association expects a harvest of 6.4 million tons in the current season. The first harvest results are quite satisfying for the farmers Down Under. Seed sales in Germany indicate that the area under cultivation in this country could be over 1 million hectares.Winter oilseed rape has grown well everywhere in Germany and has developed quickly and well. However, the EU forecast service MARS points out that all winters are currently lacking in frost resistance. The risk of diseases and pest infestation has also increased due to the mild temperatures and the rapid development, according to the forecast service. European imports continue to move at a higher level compared to the previous year. The import volumes and the good domestic harvest are therefore putting pressure on prices on the markets, which is likely to continue in the coming days. Soybeans paused trading yesterday Thursday. The CBoT was closed due to the US holiday Thanksgiving and will only start trading again this Friday. On a weekly basis, the contracts on the CBoT increased slightly. The declining demand for soybeans in China and concerns about the global economy did put pressure on prices. On the other hand, the prospects for Argentina and the foreseeable end of the US soybean harvest could boost prices. Good figures on the export front also provided support. The grain exchange in Buenos Aires yesterday confirmed its previous forecasts for the Argentine soybean harvest.The sowing lags behind very clearly compared to the previous year. Just 19.4 percent of the targeted space has currently been ordered. The deficit in sowing compared to the previous year is almost 20 percentage points. The originally planned cultivation area of 16.3 million hectares is therefore more than questionable. Precipitation fell in the drought-stricken country, especially last weekend, but the small amounts did not bring any relief for the soil and plants. Chinese imports of soy and soy products hit a new low in October.

ZMP Live Expert Opinion

Rapeseed continues its downward trend undeterred. The supply in this country and globally is good, thanks to significantly better harvests in Europe and Canada. In the soybean complex, while the prospects for Brazil and currently quiet demand from China are putting pressure on prices, sustained concerns about Argentina's harvest and slow sowing are supportive. The fact that the US dollar has weakened recently also makes US soy exports somewhat more attractive in price terms.