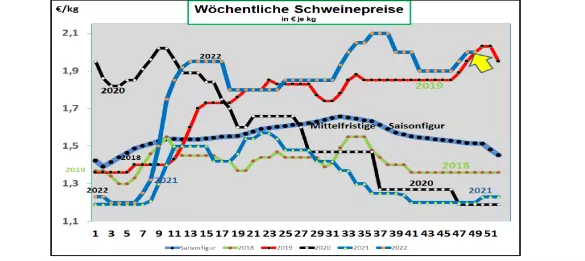

Germany: V price 2.00 €/kg (range 2.00 – 2.05 €/kg) - live supply remains low The weekly slaughter figures are around 772,366 pigs ( previous week 781,467 ) smaller; the slaughter weights have decreased somewhat with 97.1 kg . Advance registrations remain repeatedly low at 252,400 hogs (previous week 251,700 ). When reselling the cuts to food retailers, processors and for export, the average prices have increased by a further 7 ct/kg to €2.35/kg . At the ISN auction on Tuesday, December 06, 2022 , an average price of €2.10/kg was achieved in a range from €2.08 to €2.15/kg.The V price has increased by €2.00/kg for the period from December 8th, 2022 to December 14th , 2022 ; the range is from 2.00 to 2.05 €/kg. ASF : As of December 6th, 2022, 4,647 ASF infected wild boars in Brandenburg, Saxony and Mecklenburg have been officially confirmed. The development does not yet show any significant declines. For the first time in 5 years, an ASF infected wild boar has been found in the Czech Republic. Market and price development in selected competitor countries: In Denmark , prices in the 49th week of 2022 remained at a comparable calculated €1.88/kg. In Belgium , the prices in the 49th week of 2022 have been raised by +5 ct/kg to 1.92. The pre-Christmas business supports meat sales. In the Netherlands , the prices in the 49th week increased by 2 ct/kg to a comparable €1.88/kg.In France/Brittany , prices remain unchanged at €1.81/kg . The slaughter figures are an average of 381,414 pigs. Slaughter weights are slightly lower at 96.4 kg. In Italy , the listings in the 49th week of 2022 were withdrawn by a further 2 ct/kg at €2.01/kg . The high price level is dampening demand. In Spain , prices in week 49 of 2022 remained at a comparable €2.15/ kg. An increasing supply of live meat meets limited meat sales at home and abroad. In the USA/IOWA , prices have fallen further to the equivalent of € 1.76 /kg . Battle numbers remain at a high level, but valuable cuts have increased significantly; Processing goods are paid less: typical for the Christmas business. For Dec-2022 the futures prices on the stock exchange will be 1.72 €/kg . Brazil: Producer prices have stabilized on average at €1.64/kg with REAL unchanged. The football World Cup and the pre-Christmas business continue to ensure brisk domestic sales. Exports provide complementary support. China: Prices have stabilized at the equivalent of € 4.64/kg for the time being. The exchange rate has strengthened again. Forward rates for the month of Jan-2023 are trading at €3.77/kg. After the Chinese New Year celebrations at the end of January 2023, prices are expected to fall further below the €3.50/kg mark, as supply increases and demand decreases, as is typical for the season. Conclusion: Comparatively low slaughter numbers and a significantly lower stock level in the cold stores ensure that prices tend to rise in the run-up to Christmas. Prices for cuts passed on to the food retailer have increased further.There are still 2 full battle weeks until Christmas, which have the potential for price increases. After that, experience has shown that it becomes more critical.

ZMP Live Expert Opinion

The fixed pork prices are primarily due to the persistently low supply of live pigs. Support comes from low cold store inventories. The prices for cuts when resold to food retailers and processors increase due to the pre-Christmas demand because the goods are scarce. There are still 2 full weeks until Christmas with upward price potential, after which experience has shown that the sales situation and price development will become more difficult.