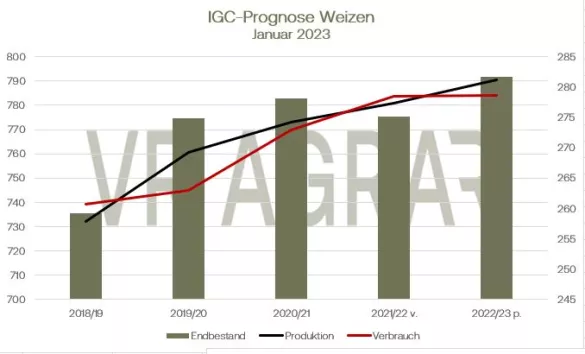

With the exception of Wednesday, wheat has headed south every day this week. When the front month of March 2023 closed at EUR 288.75 per tonne last Friday, the scoreboard on the Paris Stock Exchange was still EUR 284.75 at the closing bell on Thursday. Corn contracts on Euronext/Matif also fell, although the losses in corn were smaller than in wheat. The trend remains in tact here too. From 280 euros per ton last Friday, it went down to 278.00 euros. Wheat prices were also weaker on the CBoT, while corn rose slightly here. The outstanding argument in the wheat market is the international competitive situation. Russia's record harvest sets expectations. Although exports were a little lower than expected at the beginning of January and exports also fell slightly in December due to the weather, analysts in Russia are optimistic for the second half of January and the second half of the financial year as a whole. Russian President Putin made a statement this week and made it clear that he was interested in ensuring his country's food security.With regard to wheat exports, too, he made it clear that he was prepared to take measures to limit exports in favor of security of supply. Turkey stocked up on large quantities of wheat from Russia earlier this week, and Egypt has also bought wheat from the Black Sea. WASDE, which was published at the end of last week, hardly played a role this week, at least in wheat trading. There are also weaker price quotations on the local cash markets. On average, the prices for feed wheat and bread wheat, but also for barley, fell. The willingness of farmers to sell has increased somewhat, but due to different price expectations, only a few lots are traded. As of January 15, EU exporters exported 17.67 million tons of wheat. Despite the international competition, the French Ministry of Agriculture is optimistic that France's wheat exports will be better than previously assumed. The Ministry of Agriculture increased the export estimate by 600,000 tons to 10.6 million tons. Better weather forecasts for the Great Plains and the Midwest as a whole have put selling pressure on in recent days.US winter wheat crops suffered from drought both in the fall and now in January. The snowstorms and the cold spell around Christmas had also damaged wheat stocks. Rain has now come and more rain is forecast for the weekend. EU maize imports continue to be very dynamic. By January 15, EU importers had imported 15.66 million tonnes of corn into Europe, an increase of 7.35 million tonnes. Brazil remains Europe's largest supplier. The first corn harvest has already begun there. Analysts and market observers are expecting a good harvest. The Brazilian statistics authority warned this week that the storage capacities may not be sufficient in view of the very large soybean harvest and the simultaneous corn harvest. It would be particularly critical in February and March. US ethanol production has picked up again and inventories continue to fall. Mexico bought 195,000 tons of corn from the US yesterday. The Ministry of Agriculture in Kyiv estimates the country's corn exports to date at 13.8 million tons, which is an increase of 6 percent compared to the previous year.In December, around 1/3 of the maize stocks in the war-torn country were still unharvested. Although the farmers have now halved this area, according to the Ukrainian Minister of Agriculture, around 10 percent of the maize harvest is likely to have been lost due to the loss of quality.

ZMP Live Expert Opinion

The downtrend for wheat and corn is still intact. However, the momentum of the price reductions has slowed down recently, but there is no sign of bottoming out. The harvest in the southern hemisphere will have an impact in the next few weeks, but the Russian harvest is likely to be more dominant as the season progresses. The fact that China is importing more wheat again should support the market overall.