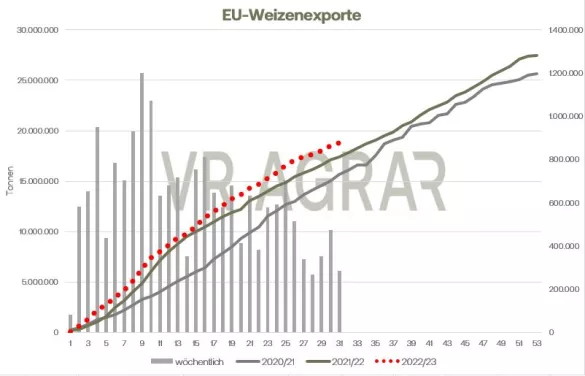

After surging late last week and early this week, wheat contracts fell again, continuing their trend. Over the course of a week, wheat on the Euronext/Matif went south from EUR 288.75 last Thursday to EUR 283.00 yesterday. For the whole of January, the March contract fell by EUR 21.50. At first. Maize also fell on the Euronext and closed yesterday in the front month of March at a closing price of EUR 275.75 per ton. While wheat is trading weaker in the first two days this Friday, the corn contracts can increase slightly up to noon. The news situation has changed little. Slight doubts are still being expressed about Russia's record harvest, but there is still strong competition from cheaper offers from the country. According to the latest reports, Egypt has bought larger quantities from Russia at US$ 322.80 per tonne (including freight). The cheap European offer apparently came from Romania and amounted to 340 US dollars per ton. The Association of the Ukrainian Grain Industry significantly reduced its forecast for the coming grain harvest.The estimates of various analysts, including those of the USDA, forecast very different values for the war-torn country, but one thing remains clear: the Ukrainian harvest will be small, regardless of the further weather conditions in spring. At the moment, however, the Ukrainian deliveries are still causing price pressure, especially in the neighboring countries, which are therefore also looking for a solution at European level that will benefit the farmers there. Different reports can be heard on the cash markets in this country. In the south, the willingness to sell and the interest in buying are obviously increasing, while in the west and north, and in parts also in eastern Germany, the cash market does not result in any transactions worth mentioning. The feed mixers are only active on the market for a very short time in the north and east, since their farmers also only make short-term deliveries due to the volatile grain and rapeseed prices. In southern Germany, it is said that sales of malting barley are increasing. The EU export figures are still at a high level. In the current marketing year, the EU countries exported a total of 18.78 million tons of wheat to third countries.With the most recent export report by the EU Commission, the lead over the previous year has increased again somewhat. However, it should be pointed out that the German export figures in particular could be inaccurate, since the authorities here have changed their reporting system and not all the problems resulting from this change have been resolved. On the other hand, wheat contracts on the CBoT increased on a weekly basis. Yesterday's export sales were disappointing across the board, but the coming cold spell in the Midwest is pushing prices higher. In addition, the US dollar has increasingly lost strength in recent weeks, which in turn could make US wheat more attractive as the season progresses. In the last week, however, there was still no sign of this. With 136,000 tons sold, even the most pessimistic analyst estimates were undercut by more than half. The mood on the corn market in Germany continues to be characterized by low domestic production combined with good market availability due to high imports. As of January 26, the 27 EU countries have imported 16.46 million tons of corn, almost 7 million tons more than in 2022 at the same time.More than 80 percent of the corn deliveries come equally from Ukraine and Brazil. While the prospects for Ukraine are significantly reduced in terms of the coming sowing and harvest, the USDA raised expectations for the Brazilian corn harvest in a report. The experts at the Ministry of Agriculture are expecting maize production there this year to be around 125.5 million tons. Compared to the January WADE, this corresponds to an increase of 500,000 tons. Harvesting of the first corn sowing has begun. There is speculation that the second corn planting could go into the ground much later, as the soybean harvest is only picking up speed. Unlike wheat, export sales volumes from the USA were very good yesterday, significantly exceeding previous expectations.

ZMP Live Expert Opinion

The grain markets on both sides of the Atlantic are doing somewhat differently at the moment. In Europe, competition from Russian wheat has become much stronger, as the latest tender from Egypt shows. In addition, the reduced pig and sow stocks ensure a lower demand for feed grain. The trends for wheat and corn mostly point to lower prices, but the year has always shown that a surprise can come from anywhere.