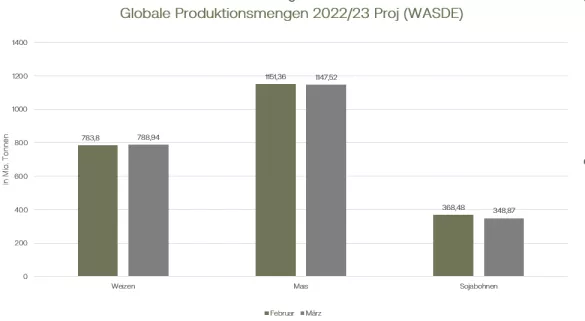

Wheat and corn were down this week. Various messages pressed on the listings. The most important is the hope for an extension of the grain agreement for Ukraine. Wheat on the Euronext/Matif in the most traded May contract closed yesterday with a daily loss of 3.25 euros at 263.50 euros/t. On Monday of this week, the same contract was quoted at 271.25 euros/t at the closing bell. Corn slipped in the new front month of June from EUR 271.75/t last Friday to EUR 260.25/t yesterday, Thursday. As representatives of the United Nations and Russia announced yesterday, talks to extend the grain agreement will be held in Geneva next Monday. After a visit to Kiev, UN Secretary-General Guterres reiterated his demand and desire for an extension and underlined the importance of the agreement for food security, particularly in poorer countries. Russia's Foreign Ministry, on the other hand, repeated its criticism and insisted on better conditions for its agricultural exports, especially in the fertilizer sector. However, Russian exports continue to develop positively overall. The good harvest, which according to their own statements was more than 104 milliontons of wheat and cheap export prices mean that American and European exporters are often uncompetitive. The March WASDE published on Wednesday did not bring any moving news for the wheat market. US Department of Agriculture (USDA) analysts slightly raised global production outlook and ending inventories. In particular, the good Australian harvest leads to these changes. Overall, however, the market was not particularly impressed by the figures. The USDA still only expects a Russian harvest of 92 million tons and is thus well behind the figures coming from Moscow. As of March 5, European exporters have exported 21.02 million tons of soft wheat to third countries in the current season. However, the quantities in the last two weeks were well below the average weekly values for this season. At the same time in the previous year, 19.51 million tons were exported. Barley exports are well behind the values of the previous year. The weaker demand from China is particularly noticeable here. The nationwide strikes in France against the government's pension plans are causing problems in the country's logistics.Business on the cash markets in Germany continues to be limited. Although farmers are increasingly willing to sell and ask for prices more regularly, the feed mills in particular are currently reluctant when it comes to the scope of new business. The spot market prices have recently been lower. Maize imports in Europe continue to develop very dynamically. In the last calendar week alone, 474,910 tons of corn were imported. Spain and the Netherlands in particular show high import requirements, while imports to Germany do not play a significant role in the import statistics. A total of 18.56 million tons were imported up to the 36th calendar week of the current 2022/23 marketing year. At the same time in the previous year, it was 11.6 million tons. The CBoT also showed weaker tendencies yesterday in the course of the overall negative environment. Declining crude oil prices also weighed on listings in Chicago. The continuing gloomy prospects in Argentina and solid export sales did little to change this. At around 1 million barrels per day, US ethanol production was last week at the level of the previous week. Ethanol inventories are declining.

ZMP Live Expert Opinion

Grain prices remain under pressure. Both the cash market and the international futures markets are showing downward price trends this week. The market is counting on an extension of the grain agreement. From this comes, will show in the next week. Potential for swings in both directions remains.