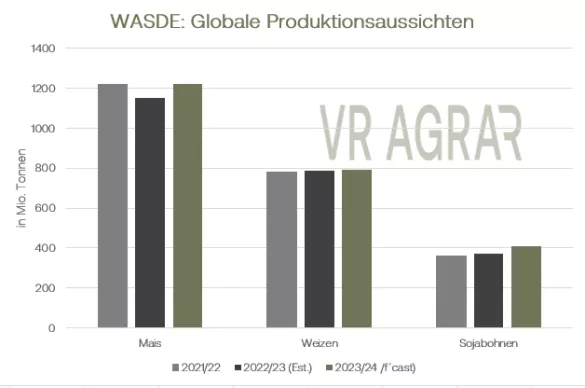

The trading week now ending was marked by the grain agreement. Up to and including Tuesday, it still looked as if the agreement on the safe transport of agricultural goods across the Black Sea, which had been in effect since July, would not continue. On Wednesday afternoon, Turkish President Erdogan announced that agricultural goods could be shipped from Ukraine for a further two months . This put considerable pressure on wheat prices and corn prices. Yesterday, Thursday, the Euronext/Matif display board in Paris showed a closing price of 222.25 euros/t in the front month of September. Prices on the CBoT also fell very significantly in some cases. Since the beginning of the month, the September date has been moving southwards by EUR 14.25. On the local spot markets, bread and feed wheat also went south. Sales are still low, especially this week only a few quantities of grain were traded due to the public holiday. In addition to the extension of the grain agreement, better earnings prospects for the USA are also having a negative impact on wheat prices.The USDA revised average condition ratings slightly upwards earlier in the week and weather conditions across the Great Plains remain benign. At the same time, demand for US wheat is weak. Cancellations caused the USDA to announce a negative net worth of 42,000 tonnes for the current season yesterday, Thursday. Sales for the coming harvest are also weak, totaling 1.9 million tons so far, down around 70 percent from last year's figure. Europe's exporters shipped 299,624 tons of wheat to third countries last week, bringing total soft wheat exports to 26.48 million tons for the current season. At this time in the previous year, the EU Commission's customs statistics showed an export volume of 23.86 million tons. The momentum of maize imports, on the other hand, has slowed somewhat, but at 23.56 million tons in the marketing year to date, around 9.3 million tons more maize has been exported than at the same time in the previous marketing year. France's agriculture ministry estimates that the area under grain for the 2023 harvest will be 8.87 million hectares, down 1.1 percent from the previous year.In particular, the area under corn is declining, and in many cases farmers are switching from corn to sunflowers and rapeseed. A similar development can also be seen in Germany. In the case of US corn, currently weak demand and the prospect of higher global production are also having a negative impact on prices. As the USDA announced in its WASDE last Friday, global corn production is expected to increase by around 6 percent compared to the previous year. The Ministry's experts assume a global harvest of 1,219.63 million tons. This was primarily due to higher US production and more normal expectations for Argentina. Due to the war, less corn is expected for Ukraine than in the previous year.

ZMP Live Expert Opinion

Ukrainian grain exports continue. The agreement is extended by 2 months. Grain prices remain under pressure due to the expected higher production of corn and signs of a better grain supply overall. The weather conditions in the coming weeks will decide whether prices will remain under pressure. The growth conditions in Europe, in Russia and also in the Ukraine are currently good. Conditions have improved in the US.