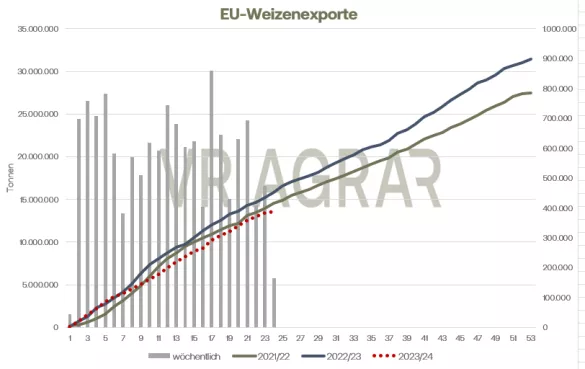

Wheat has fallen significantly in the week now coming to an end. The new front month of March closed yesterday, Thursday, with a settlement of 223.00 euros/t, which was 4.50 euros lower than on Wednesday. Even on a weekly basis there is a clear loss on the scoreboard. In Chicago, prices also fell significantly over the week, although contract prices corrected slightly yesterday after very large losses on Wednesday and Tuesday. Corn fell back below the 200 euro/t mark on yesterday's trading day in the front month of March 24 and ended the trading day with a closing price of 198.50 euros/t. The CBoT also went south for the corn contracts. Overall, the grain market was still under the influence of the WASDE report, especially at the beginning of the week. The USDA had issued higher harvest forecasts primarily for Canada and Australia, which also increased global production compared to the November estimate. With overall strong export competition primarily from Russia, this put pressure on prices on both sides of the Atlantic. Russia's export prices have recently risen again, but have had no lasting impact on domestic prices.The euro is also strengthening again and the latest EU export figures show that local exporters continue to have problems placing their quantities on the world market. Ukrainian grain exports are also below the previous year's level. According to the Ministry of Agriculture in Kiev, 14.7 million tons of grain were exported in the current season. At this point in the previous season there were already a good 20 million tons. Of the 14.7 million tons, 6.3 million tons are wheat (previous year 7.4 million tons) and 7.4 million tons are corn (previous year 10.9 million tons). Trading activities remain manageable on the local cash markets. There are comparatively few discussions about contracts for the new harvest at this time of year. Observers justify this on the one hand with the experience of many producers last year in being able to place their quantities well during the harvest as well as with the reluctance of the national trade in relation to pricing for the coming year. Grain logistics, especially in southern Germany, are currently restricted due to flooding on the Rhine and Danube, but there are currently no fears of supply bottlenecks.The demand for corn is also limited, with domestic offers definitely facing competition from cheaper offers from Eastern Europe. In France, the coming harvest is likely to be smaller. Due to the capricious weather, not all targeted areas could be cultivated. According to the agricultural authority, the cultivated area is said to have decreased from 5.1 million hectares to 4.49 million hectares compared to the previous year. This means that the area is 4 percent smaller than the previous year, but the long-term average is still exceeded by 3.1 percent.

ZMP Live Expert Opinion

Exports in Russia are doing better again after the storms on the Black Sea and Ukraine is also hoping for more dynamic exports with the experience of the alternative trade route. If the USDA figures are correct, the global harvest is likely to be larger than previously thought. With spot market activity calm, overall grain prices remain under pressure.