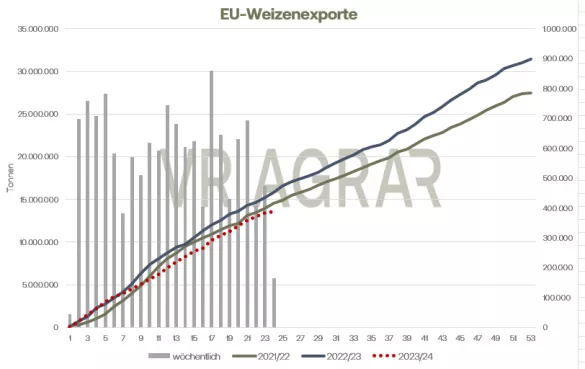

Wheat has trended slightly southward so far this week. While last Friday there was a closing price of 224.00 euros/t in the front month of March on the display board of the Paris stock exchange, yesterday at the closing bell it was still 222.25 euros/t. At the start of today's trading day, there are once again slightly weaker price trends on Euronext/Matif. The bottom line at the CBoT was also going south. Corn, on the other hand, is trading slightly higher and closed yesterday at 199.75 euros/t. However, with the start of the last trading day before Christmas, weaker trends are also evident here. As the Federal Statistical Office announced, the area under cultivation for winter cereals fell by a good 3.9 percent compared to the previous year. Of the total area of 4.9 million hectares, winter wheat still accounts for the largest share. This year this amounts to 2.6 million tonnes, a decline of 7.3 percent or 203,800 hectares. Areas are declining particularly sharply in Lower Saxony (-58,400 hectares) and Schleswig-Holstein (-31,300 hectares). Up to 20.9 percent less space was ordered here. One reason for this is the wet soil during the sowing phase.Access to the fields was sometimes impossible. But new direct payment regulations are also cited as a reason for the sharp decline in winter wheat area. Rye is also grown on a smaller area, but the winter barley area has increased by 2.5 percent to 1.3 million hectares. In France there is also a decline in wheat cultivation areas. As the private analysis house Argus Media estimates, the area there is around 11 percent behind that of 2022/23. Europe's export figures this week are also significantly behind last year's volumes. Recently, however, a little more wheat was able to be loaded again over the course of the week. The situation on the Red Sea is also causing uncertainty in Europe. Across the Atlantic, export sales figures are also declining. The recent shopping spree from China to the US did not continue this week. Nevertheless, the weaker US dollar is supporting export opportunities. In corn trading on the CBoT, traders are primarily looking at the weather developments in Brazil, which have recently brightened.Export sales were also positive this week and over the marketing year to date, more volumes were sold on the world market. There was little trading on the local cash markets this week. New crop contracts were also only traded to a manageable extent. Agricultural trade and the feed industry focused primarily on processing existing contracts. Here and there it is said that the compound feed industry in particular is pushing back agreed deliveries.

ZMP Live Expert Opinion

The news situation decreases significantly at the end of the year. A clear trend can only be derived to a limited extent from this. The pressure from last week remains latent, even if there are no signs of a sharp fall in grain prices.