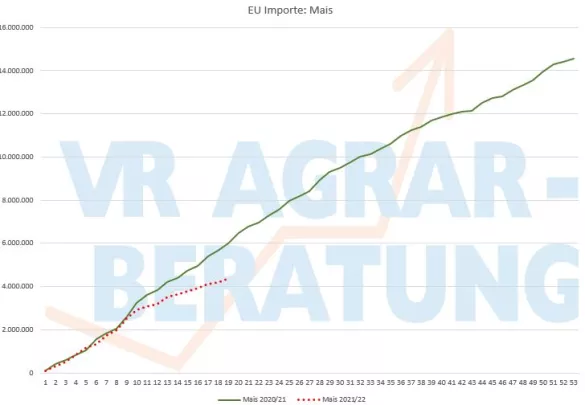

After the start of the week with heavy losses, the green signs were able to prevail again on the Matif and ensure moderate profits. The German Raiffeisen Association published its latest assessment of harvest 21 yesterday. For wheat in particular, production fell by a total of 2.5%. Above all, the areas have shown a decline. In 2020 the cultivation amounted to 2824.3 (1,000 ha). A similar development can be seen for barley and rye. Here, too, the areas have continued to decline. The analysts from Strategy Grains have revised the forecast for EU export business down to 30.4 million tons due to the fierce competition worldwide. That corresponds to a minus of 4.7 million tons. The global production forecast has been lowered by the IGC to 777 million tons. The main reason for the correction are unfavorable growing conditions in the Middle East. In Chicago, futures closed trading on a mixed note. After the contracts had partially reached their highs again, profit-taking and technical sales led to falling prices. However, the continued high demand in particular slowed down the losses. Jordan released a new tender for 120,000 tons yesterday.According to initial results, the tender from Algeria was covered primarily with Russian goods. In the meantime, export sales in the USA totaled 399,100 tons and were thus well above the value of the previous week (+40%), as well as the average from the last four weeks (15%). The result was in line with the analysts' expectations. According to the USDA, 46% of wheat stocks are in good to excellent shape. The condition has thus improved slightly. Around 20% of the fields are in bad shape. A wheat harvest of 27.1 million tons is expected in the Ukraine. This corresponds to a decrease of 27.1%. The analysts at Sovecon are primarily responsible for the declining acreage as well as the high fertilizer prices. In the slipstream of the wheat contracts, maize also returned to profitability on the Matif. The German Raiffeisen Association is assuming a good maize harvest of around 4.2 million tons (+%% compared to the previous year). Wet fields continue to delay the harvest because there is a lack of drying capacity, especially in the south and west of the country.At the same time, logistics problems cause difficulties during loading. The corn contracts on the CBoT followed the guidelines of the wheat exchange rate and fell again and again in the course of trading. Again, profit-taking and technical sales put prices under pressure. According to the US Department of Agriculture, around 904,600 tons of corn were sold last week, just above the lower end of expectations. The result from the previous week was undercut by 15%. In total, the shipments reached 1.167 million tons, marking a new high. Despite the currently somewhat weaker export business, US dealers expect a positive development in the coming year. According to the latest information from the US Energy Administration, the average ethanol production was 1,060 million barrels. Production increased slightly compared to the previous week. Inventories have decreased to 20.081 million barrels. In Argentina, the recent rainfall has created good growing conditions in the now important development phase of maize. So far, around 29% of the planned acreage has been cultivated. The experts from the Buenos Aires Exchange anticipate a production of 55 million tons.

ZMP Live Expert Opinion

Despite minor corrections, there is currently no sign of a trend reversal in fixed grain prices. Above all, the continued high global demand and recurring concerns about a shortage of supplies provide the bulls with food. Market participants are looking forward to the coming season and the production prospects. Should growing conditions improve significantly, this could give the bears the lead.