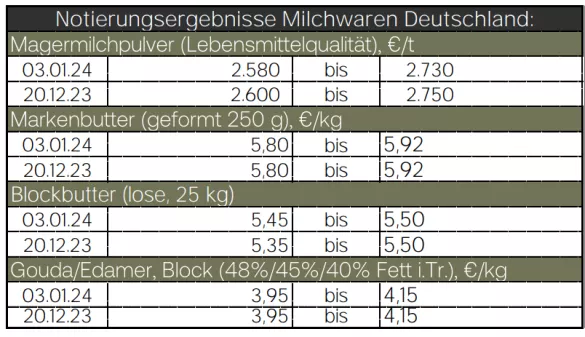

Most recently, milk production continued to rise at the end of December. In the 50th calendar week, around 1.1% more raw milk was delivered. The gap compared to the same week last year has also decreased significantly. Overall, dairies had around 1.4 percent more milk available to them in the first 50 calendar weeks. The raw material markets ended 2023 relatively balanced, but prices were mostly under pressure at the end of the year and at the start of the year. The ife Institute determined a spot market price of 33.8 cents/kg for the 51st calendar week, a very significant decline of 13.8%. The orders for molded butter have fallen behind their pre-Christmas records. After the holidays and in the first week of the new year, demand calmed down significantly, but manufacturers remain satisfied with sales. The price in Kempten remained unchanged; at consumer level, prices in the entry-level price segment were firmer at 1.69 euros/250 grams. Blockbutter starts the new year like it came out of the old one. Market developments continue to be calm and manageable.The price in Kempten was able to increase slightly again at the lower end, but is still quoted weaker than in mid-December. There is currently hardly any demand for exports, but the overall availability of goods is more than sufficient as the quantity of milk is higher again. At the first auction in New Zealand, butter rose by around 1 percent and was quoted at the equivalent of 4,990 euros/t, which means that the local product is still uncompetitive. The prices on the EEX are somewhat weaker compared to “Before Christmas”. Manufacturers have not seen any slowdown in demand for cheese due to the holidays. Call-offs continue to be extensive and inventories continue to decline. Demand remained high, particularly from the food retail sector, and in some cases more quantities were ordered from the cheese factories than had previously been expected. The cheese producers are also satisfied with the first sales in 2024. In keeping with the New Year's resolutions often made, light variants are currently increasingly in demand. Demands from industry and large consumers are at the agreed level, and in some cases there is also manageable export business.Yesterday, the price in Hanover remained stable at the elevated level. Demands for price reductions come more frequently, but manufacturers do not respond to them due to the limited stocks of goods. As was the case at the end of December, the first quotation of the new year for skimmed milk powder is also under pressure. The butter and cheese exchange in Kempten reduced the price by an average of 20 euros/t. Business continues to be extremely quiet, with many market participants still on Christmas and New Year holidays. The dairies also concentrate on existing contracts in production. When negotiating later delivery dates, the price expectations between manufacturers and buyers diverge further. In the first tender in New Zealand, skimmed milk powder was also weaker, falling by 0.9%. Occasionally, new business for animal feed qualities comes about when price quotations remain stable. Whole milk powder is also starting the new year at lower prices. The business is focused on customers in the domestic market as the powder remains uncompetitive internationally. Prices in the Global Dairy Trade Tender continued to rise, with the equivalent of 2.At 977 euros/t, whole milk powder in New Zealand is significantly cheaper than in Germany, where whole milk powder costs an average of 3,825 euros/t. Whey powder, on the other hand, has a solid start to the new year. The prices were able to increase and despite the holiday season there is a decent level of demand, which also results in transactions.

ZMP Live Expert Opinion

The Christmas business resulted in high levels of goods being issued. These have now calmed down significantly in some cases, but dairy products are still in demand among consumers. Internationally, however, local manufacturers continue to lack competitiveness. The outlook for the new year is firm, although the market is on slightly shaky ground.