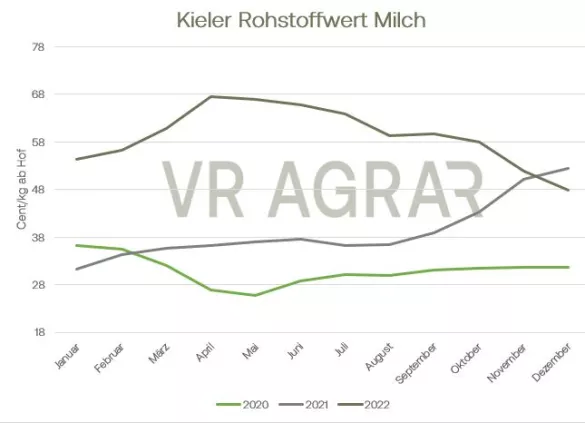

Shortly before Christmas, the seasonal increase in milk volumes was halted by the very frosty temperatures in Germany. In the 50th calendar week of 2022, around 0.8% less raw milk was served compared to the 49th calendar week. Nevertheless, more milk was produced compared to the previous week in 2021, the increase is around 2 percent according to the preliminary calculations. The raw material markets did not find a uniform direction around the turn of the year and also developed very differently from region to region. In the case of skimmed milk concentrate, there seems to have been something of a bottom formation, while prices for industrial cream continue to trend downwards. Spot market prices for milk were not determined between the holidays, only in the Netherlands was there a slight increase in price levels. The Kiel commodity value for December fell again and for the first time fell below the mark of the same month last year. For December, the ife Institute in Kiel determined a value of 47.9 cents/kg ex farm, in December 2021 it was 52.4 cents/kg. Compared to the previous month, the raw material value fell again by 4.0 cents/kg. As is typical for the season, the demand for formed butter fell after Christmas.However, the market participants are still satisfied with the calls, the fall in demand does not seem to be as pronounced this year as in other years. There is no impetus and due to the many New Year's resolutions that have been made, hardly any lasting impetus is expected for January either. The listing in Kempten for packaged butter fell at the lower end by 0.12 euros/kg, consumers are currently paying 1.99 euros for the 250 gram packet of branded butter and thus significantly less than at the beginning of December. Between the holidays and at the start of the year things were also quiet at Blockbutter. There were hardly any new deals, also because many of the players are or were on vacation. With the first listing on the southern German butter and cheese exchange in Kempten, block butter went south again. The listing was set at EUR 5.00 to 5.05 per kilogram, which is 10 cents less at the lower end of the trading range and 25 cents per kilogram at the upper end than in the last listing in 2022. Prices on the EEX also fell , although here the downward price dynamic has continued to slow down. The butter index of the EEX fell significantly, in particular due to the significant fall in prices in the Netherlands and France.Demand for semi-hard cheese calmed down after the public holidays. However, orders are still at a satisfactory level, particularly in the food retail sector. The inexpensive own brands of supermarkets and discounters are still in demand among consumers. Sales and business transactions in the direction of bulk consumers are still at a calm and cautious level, but there is a slight increase in interest in new contracts. Internationally, local cheese has become more competitive again, and more and more orders are being received from southern Europe. The quotations for Gouda both as block and bread products fell at the first price determination of the year. The new year is almost unchanged for the powder markets. Although food-grade skimmed milk powder fell at the high end when it was first listed in 2023, the market remains calm. Many market participants are slowly returning from the Christmas holidays, so significant activities are only expected for the coming week.However, the recently significantly lower price level ensures that there are more talks about short and medium-term deliveries. In Tuesday's Global Dairy Trade Tender, international prices for skimmed milk powder fell another 4.3%, but EU goods remain competitive. On the EEX, the prices for skimmed milk powder have recently stabilized slightly on a weekly basis. On yesterday's trading day, extensive quantities were traded from April 23 again at more favorable prices. Whey powder has lost significantly over the course of 2022 and is cheaper than at the beginning of 2022. Demand is increasing, however, while inventories are manageable at the same time.

ZMP Live Expert Opinion

The milk market started the new year unchanged. The price level fell significantly in the second half of the year and should soon be reflected in the basic prices paid by the dairies. There are first signs of bottoming out, but whether this is sustainable will have to be proven in the coming weeks.