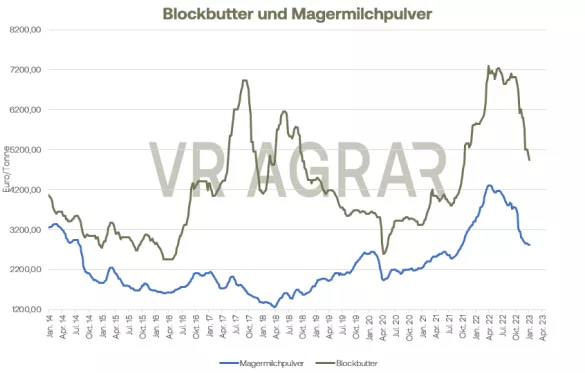

With the new year, farmers in Germany are delivering more milk again. Looking back at last year, the milk volume in the first half of the year was well below the previous year's line, but was caught up especially at the end of the third and fourth quarters of 2022. According to preliminary calculations, only 0.1% less milk was delivered in the period from January to December than in 2021. At times, the deficit compared to the previous year was up to 1.8%. At the turn of the year, industrial cream is showing an upward trend again, prices rose in the first weeks of January. Skimmed milk concentrate was also up again at the beginning of January, with around EUR 0.30 more being called for per kilogram of dry matter than at the beginning of December. Spot market milk continued to get cheaper. Here, the federal average of 33.4 cents/kg is called up by the ife Institute, which is another 6.3 cents less than in the previous week. The butter markets are still under price pressure. Demand from the food retail trade calmed down further at the beginning of January and is at the low level that is typical for this time of year. Different inventories are shown in the plants.While some can report well-stocked inventories, other manufacturers report empty warehouses. The price for packaged butter at the South German Butter and Cheese Exchange in Kempten was also reduced for the second time this year. There are still hardly any signs of impetus on the block butter market. Demand is calm, buyers continue to act cautiously and cautiously. Prices fell again during yesterday's trading session. This development can also be seen on the EEX. The average quotations over all contract terms fell by more than 136 euros per ton on a weekly basis. Butter prices also fell significantly in yesterday's session and, with the exception of the front date, are always below the EUR 5,000/t mark. From June/July there are signs of firmer prices on the EEX again. The market for semi-hard cheese is also weaker, as is typical for the season. The outgoing quantities are declining. More and more retailers are reporting an increasing reluctance to buy, which also goes beyond the normal seasonal level. There are still hardly any new contracts from industry and bulk consumers.Contracts are retrieved normally, new contracts are only rarely created. As with butter, the traders are relying on short-term deliveries and are waiting for further price developments. The listing commission in Hanover also reduced the trading range at both ends for block goods for the second listing this year, bread goods remained stable with a listing of 4.30 to 4.70 euros/kg. Nevertheless, since the beginning of December there have also been weaker price trends here. Weaker price trends are also evident for food-grade skimmed milk powder . The trading range on the butter and cheese exchange in Kempten was reduced by a significant 45 euros on average and the price trends on the EEX are also still falling. Trading activities have recently increased again significantly here. Activity on the cash markets has also picked up again compared to the first week of January. Interest in buying has recently increased again, also because of the reduced price level. Feed grades, on the other hand, are hardly traded.Demand for whole milk powder has increased again recently, the European food industry in particular is showing a need, but new contracts are only being concluded at a reduced level in terms of quantity and price. With weaker prices, whey powder is also on a calm course. Here and there there is interest in buying on the European domestic market, but there are still hardly any inquiries at the whey plants from exports to third countries. The trading range was set at 900 to 1,000 euros/t yesterday, which is 50 euros lower at the lower end and 30 euros lower at the upper end than in the previous week.

ZMP Live Expert Opinion

The direction remains: south. Prices are still under pressure. Ray of hope: the lower price level is slowly but surely attracting buyers again in the first sub-markets. International competitiveness is also back for many dairy products, so that impulses could come here in the further course of time. Overall, however, the market remains difficult.