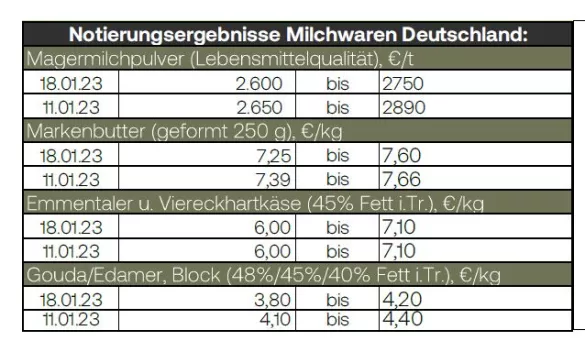

The volume of raw milk is steadily increasing. According to preliminary calculations, around 1.6% more milk was delivered for the first calendar week of the new year than in the last week of December, and compared to the first week of 2022 there is even 4.2% more milk available. After a brief upturn in prices on the concentrate markets, cream and skimmed milk concentrate are currently weakening again. This is mainly due to the higher volume of milk available to the market. On the sports market , the listing fell again by 1.8 cents/kg to 31.6 cents/kg on average across Germany. The butter market is showing signs of revival. Prices are still under pressure here, but orders from food retailers are increasing again. In addition to butter, spreadable fats, for which demand had calmed down significantly after Christmas, are also being called up more extensively again. The current contracts with food retailers usually run until the end of January, the southern German butter and cheese exchange lowered the price for packaged butter yesterday, especially at the lower end of the trading range. Demand for block butter is also busier.Due to the higher milk deliveries, however, prices are still under pressure here. Manufacturers are now receiving inquiries for all delivery times up to and including the fourth quarter of 2023. On the EEX, butter prices fell again in a weekly comparison. For example, the butter contract for May 2023 fell by 325 euros from 4,700 euros/t last Wednesday to 4,375 euros/t yesterday. The forward curve also shows that market participants expect lower prices in the first half of the year, but then expect firmer prices again in the second half of the year. The situation with cheese continues to be subdued. However, the demand for semi-hard cheese from the food retail trade has increased slightly compared to the previous week. Typical for the season, consumer demand is weaker in January. Customers from industry and the general consumer sector continue to show a wait-and-see attitude with regard to orders and new contracts. Due to the milk volume, which has increased significantly since the beginning of November, the availability of goods is high, while at the same time the goods issue is lower. New contracts are concluded at a reduced level.On the other hand, sales volumes for export continue to rise, but here too there are price reductions. Inventories are higher and getting older. Yesterday, the listing commission in Hanover repeatedly and significantly lowered its price ranges for Gouda (block and bread products). The average prices from January 2022 are now undercut. The market for food- grade skimmed milk powder is largely unchanged. The prices continue to fall and the EEX powder index for Europe also fell very significantly yesterday. Due to the higher quantity of milk, the availability of goods is also higher here and the willingness of manufacturers to sell has increased significantly. Buyers are currently showing little demand and are holding back on new business in expectation that prices will continue to fall. Export demand also remains subdued, only from the Middle East region are there slight increases in call-off volumes and interest. Skimmed milk powder also fell in the Global Dairy Trade Tender in New Zealand. The price drop here is 0.3%, the index is the equivalent of 2,621 euros/t, which means that European prices are competitive.There are few new contracts in the European environment for whole milk powder , and here too the price quotations have recently fallen again and again. Whey powder is still trading at a higher volume, but both food grades and feedstuffs are under pressure in terms of price, the prices were reduced by the southern German butter and cheese exchange in Kempten. Due to the declining prices for butter and skimmed milk powder, the market milk values are also falling significantly. Between February and June 2023, the values are below the mark of 40 cents/kg. Some of the sellers' ask prices are below the settlement prices.

ZMP Live Expert Opinion

The price pressure on the milk market and the sub-markets remains high. For December 2022, the first dairies have already lowered their payout prices. The proceeds from milk processing are declining, the market milk values have already fallen below the mark of 40 cents/kg in a few delivery months. The larger milk supply should not change this trend for the time being.