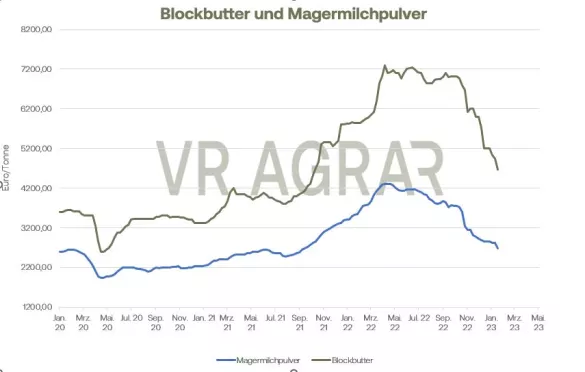

The milk volume continues to increase. According to initial calculations, the dairies once again recorded more milk than in the previous year and the previous week. The higher volume of milk continues to put pressure on demand and price developments on the concentrate markets. While skimmed milk concentrate is traded at stable to slightly weaker prices on average across the federal government, cream in particular is under pressure. Spot market milk fell by 0.2 cents to 31.4 cents/kg in the third calendar week of the new year. There are also declining tendencies in the Netherlands, where 31 cents/kg are mentioned for spot market milk and thus by 7.5 percent in comparison to the previous week. In Italy, 50 cents/kg are still being traded, but recently there have also been corresponding downward trends here. The revival on the butter market continues. Orders for packaged butter are picking up again, because consumer demand has recently increased again. Most of the contracts between dairy and food retail will run until the end of the month. For the follow-up contracts, the parties involved expect noticeably lower prices for butter.The trading range on the southern German butter and cheese exchange was updated unchanged compared to the previous week. The increased milk volume continues to put pressure on the price of block butter, but short-term calls and inquiries have continued to pick up. In the expectation that prices will continue to fall due to the build-up of inventories, however, buyers are still only interested in short-term deliveries. Later appointments are rarely completed. The subdued price expectations are also reflected on the EEX. The contract prices for the individual delivery months continued to fall with trading activities recently increasing again. The index for butter, on which futures trading is based, was also significantly weaker. From the all-time high at the beginning of June 2022, the index lost 2,825 euros/t or 37.77% by yesterday. While there are signs of a revival in the butter market, bulk consumers and industry in particular only occasionally ordered cheese in the past week and appear to be covered with regard to their requirements for the later delivery dates. The export business is running smoothly and is rather disappointing for many traders.The Chinese New Year celebrations, which will be celebrated this week, ensure that the global market is calm overall. The stocks in the warehouses continue to increase, additional quantities from the milk delivery are increasingly being channeled into cheese production. The age structure of inventories continues to increase. Consumer demand revived after being revived in early January. However, consumers continue to focus on small packaging units. The listings in Hanover were withdrawn again. Both bread and block goods were weaker on Wednesday. As in the previous week, the trading margins at both ends were reduced by 0.20 euros/kg. The revival in the market for skimmed milk powder last week was short-lived. There is currently a high range of goods with correspondingly restrained demand from industry and bulk consumers. Buyers report only small requirements, which then also relate mainly to short-term deliveries, longer-term deals are still hardly an issue in the course of the market.In international trade, the conditions for European manufacturers are certainly competitive, but the Chinese New Year celebrations ensure that world trade has calmed down overall. In addition, Europe's exporters are increasingly facing competition from the USA. Feed qualities are also declining, and the listings have also been withdrawn here. Business is mostly calm. Increasing supply quantities also put pressure on whey powder . Due to the higher cheese production, inventories have increased significantly, but these production volumes are currently hardly being absorbed by the market. Accordingly, whey powder prices continue to correct downwards. Although the prices for whole milk powder are also under pressure, calls and demand have picked up again somewhat in this sub-market. There are also increasing negotiations about deliveries in the second quarter of 2023. However, demand is primarily concentrated on the domestic market, and Europe's whole milk powder prices are still lacking in international competitiveness.

ZMP Live Expert Opinion

The pressure on the milk market is continuing and is likely to continue in the coming weeks. The market milk values have fallen further, the dairies are likely to lower the payment prices if they have not already started to do so. The rising volume of milk and the clear expectations of market participants of falling prices are putting pressure on the market.