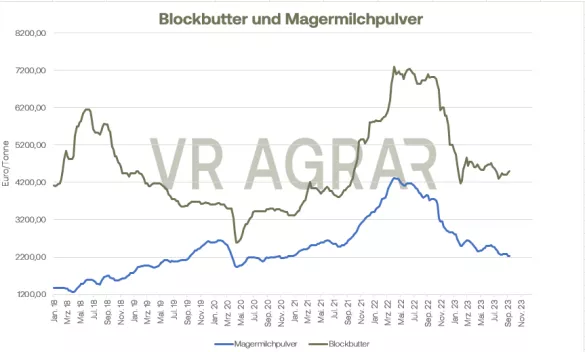

After the very significant decline in milk deliveries in the previous week, slightly more quantities were recently offered again. According to preliminary calculations, around 0.5 percent more raw milk was delivered in the 35th calendar week than in the previous week. In a direct comparison from January to August, dairies in Germany had a total of 2.2 percent more milk available. Prices are rising on the raw material markets. Demand for skimmed milk concentrate in particular has been more positive recently. Prices are rising, although there are certainly regional differences. Rahm is also being traded more firmly again. Spot market milk climbs northwards by 2.8 cents to 42.7 cents/kg. In Italy and the Netherlands, spot market milk is also quoted at rising prices. With stable prices, demand for molded butter continues to be high. As statistical data shows, food retailers are purchasing more butter than in the same week last year. Since Bavaria and Baden-Württemberg are now back from their holidays, demand has become more lively.Consumer prices remain constant at 1.39 euros for the 250 gram packet in the entry-level segment, and branded products have recently been increasingly advertised with promotional prices. The block butter market was busier in the second week of September. Deals are increasingly being concluded primarily for short-term deliveries. However, market participants are generally cautious about deliveries in the new year. Uncertainties about the further course of milk deliveries are causing both buyers and sellers to act more cautiously. At yesterday's price quotation in Kempten, the average price for block butter increased. At the lower end of the trading range, 5 cents per kg more were quoted, at the upper end it was 4 cents per kilogram. However, the export business continues to fall short of expectations. Butter prices on the EEX have recently been slightly firmer compared to the previous week's level. From the delivery month of December, market participants expect a price level above the current spot price. Cheese manufacturers are also satisfied with the orders this week, especially from food retailers.They also demanded more goods from manufacturers due to sales campaigns and offer prices. Demand and shipments of goods from the large consumer sector have decreased somewhat. Exports to southern European holiday regions are also slowly declining, and business with third countries remains quiet. Inventories are continuing to decline and are likely to remain at a low level due to the decline in milk volumes. Existing contracts can be properly supplied, but there is not always enough cheese available for additional requests. The price quotations in Hanover remained unchanged yesterday, Wednesday, but manufacturers are already entering into new negotiations with higher prices. The market for skimmed milk powder is somewhat busier but still not satisfactory. Industrial customers from home and abroad in particular are well supplied with short-term needs. Production has recently been redirected; more milk is currently flowing into cheese production.The price in Kempten rose slightly yesterday at the lower end of the trading range, but overall there is still more than enough inventory available, which is putting pressure on price developments. On the EEX, the forward delivery dates have increased noticeably on a weekly basis; the settlement prices for the first and second quarters of 2024 are above the current cash market level. Animal feed products were also quoted somewhat higher again, but business activities in this segment continue to be subdued. Business with whole milk powder has increased in terms of volume, and prices are stable. The trade in whey powder, on the other hand, is busier. Demand for both food and feed qualities increased again at the beginning of September. In particular, impulses came from the Asian region. Prices increased significantly. While the national average was 595 euros/t last week, this week it is 625 euros/t. Whey powder prices have also increased in the Netherlands and France.

ZMP Live Expert Opinion

After the end of the summer holidays in all federal states, the milk markets are experiencing some tailwind again. The demand for molded butter and cheese remains at a high level. There is a slight upturn in demand for block butter and skimmed milk powder, although expectations have not yet been met and there is plenty of stock available, thus limiting effective and significant price increases.