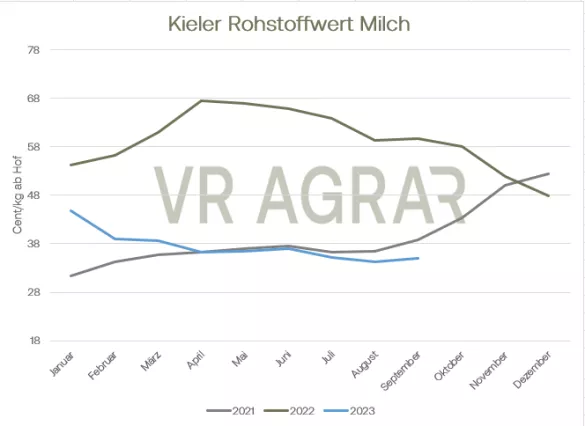

After two weeks with milk volumes increasing again, the seasonal trend of declining deliveries has set in again. Compared to the previous week, around 1.5 percent less raw milk was served in the 37th calendar week. This also leads to firmer developments in the concentrate markets. Industrial cream in particular is available in limited quantities and has been able to increase in price as demand continues to be good. Skimmed milk concentrate is also traded more frequently and is in high demand in terms of quantity despite limited supply. Spot market milk lost 0.5 cents/kg in a weekly comparison and is given a federal average of 42.6 cents/kg. The Kiel raw material value milk for September increased by 0.7 cents/kg and is given by the ife Institute at 35.0 cents/kg. Stocks and offers of block butter are becoming scarcer. Even though the number of new businesses is still at a steady pace, prices have increased. Production volumes have declined. Due to high cream prices, fresh produce is mainly still produced for existing delivery obligations.The quotation range was increased at the lower and upper ends by 25 cents to 4.65 - 4.85 euros/kg. The export business continues to show a lack of momentum. There is more demand for molded butter again in a direct weekly comparison. Prices remain stable. This applies to both the selling prices of the dairies and the consumer prices in food retailers. LEH in particular is currently increasingly purchasing goods. Because of the higher cream prices, there appear to be certain pull-forward effects. Butter contracts on the EEX went significantly northwards. As of the December supplier, the contracts are currently trading above the current spot market level. There have been few changes recently when it comes to sliced cheese . Exports to southern Europe continue to decline as is typical of the season. On the other hand, goods exported to food retailers are at a high level, and consumer demand is being further stimulated by special offers. Large consumers and industrial customers currently show little need that goes beyond the existing contracts. Ripening stocks are declining. This is also due to the declining milk delivery.The price quotations in Hanover remained unchanged yesterday. The recovery in skimmed milk powder continues. The dryers are receiving more and more inquiries, which are also leading to new business deals. The focus is on deliveries until the end of 2023. Short-term requirements are an issue in the minority of orders. When it comes to deliveries in the new year, buyers and sellers are continuing to wait. In export business, the focus is currently on the Middle East and Northern Africa. However, demand from China and other countries in Asia remains below expectations. Skimmed milk powder on the EEX also increased on a weekly basis. Animal feed products increased in price at yesterday's listing, as did food grades. Whole milk powder remains quietly traded. Although the prices rose by an average of 50 euros/t, the volumes traded and in demand remain manageable overall. Whey powder, on the other hand, is traded more extensively both for short-term deliveries and for later dates at firmer prices.Overall, the supply of whey powder is declining, as whey is no longer as widely available as it was a few weeks ago due to the declining milk deliveries. As the latest export statistics from the EU Commission show, more dairy product volumes were exported in the first seven months of 2023 than in the same period last year. Skimmed milk powder exports rose by 23 percent from 401,000 tons in the first seven months of 2022 to now 492,000 tons. Whey powder was exported 5 percent more and whole milk powder also increased sales by 14 percent despite high European prices. However, export volumes for baby food and fat-free milk powder are declining.

ZMP Live Expert Opinion

The milk market is clearly showing revitalizing tendencies. The demand for skimmed milk powder and block butter has improved, even if the volumes are still behind the previous year's values. Due to declining milk deliveries, cheese stocks are dwindling and there is less whey available for the production of whey powder. The stock market milk values are already showing price expectations above the 40 cent mark again for the first half of 2024, and from May 2024 these will already be over 45 cents/kg.