The development of milk quantities is currently not entirely typical of the season. After the decline in the previous week, slightly more milk was delivered again in the 38th week. Compared to the 37th week, around 0.2 percent more milk was served. Looking at the first 38 calendar weeks of 2023, dairies had a total of around 2.1 percent more milk available than in the same period in 2022. A further limited supply of raw materials has caused the prices for industrial cream and skimmed milk concentrate to move further northwards. There was increased interest in industrial cream, particularly from Italy. High temperatures in late summer are causing demand in outdoor restaurants and ice cream parlors to increase. For Germany, the ife Institute determined a spot market price for raw milk of 43.1 cents/kg, an increase of 0.5 cents compared to the previous week. Spot market prices also rose in Italy and the Netherlands, and even very significantly in the Netherlands. The market for butter is overall more dynamic. The demand for molded butter remains at an increased level even at the turn of the month.The dairies receive additional requests that cannot always be served promptly. In the first food retail chains, consumer prices for the 250 gram package have already risen by 6 cents to 1.45 euros, but molded butter is usually still offered at a price of 1.39 euros. Some of the dairy sales prices are already firmer; the price in Kempten remained unchanged yesterday. The recovery in block butter continues at the beginning of October. Rising cream prices in particular are causing both buyers and sellers to become more active. The current strength of the dollar is also ensuring that buyers from third countries are increasingly preferring contract goods. The recovery in the market is not yet reflected in the price quotations. The butter and cheese exchanges in Kempten lowered the trading range slightly. On the Leipzig stock exchange, the later delivery dates were able to increase in price over the last week and will be above the current market prices from November 2023. Sellers have recently been cautious on the EEX. There are currently no ask prices in the order book. There are hardly any changes in the cheese market .The orders and demand are at a high level, and the public holiday on Tuesday also caused an advance effect. Due to the rising price trends for cream, more and more buyers are approaching the factories in order to secure goods and prices. The weaker euro exchange rate and rising prices on the world market have also stimulated export demand somewhat. Stocks remain young and below average. However, nothing has changed in terms of price. The demand for skimmed milk powder is more extensive. Increasing inquiries are being received both from the internal market and from third countries. Inventory goods are still available on the market, but fresh goods are produced more manageably. Rising prices for concentrate have caused production to slow down. Manufacturers have recently been able to achieve higher prices again. The listing in Kempten increased and the EEX also shows significantly firmer prices with increased sales volumes compared to the previous week. At the Global Dairy Trade Tender in New Zealand on Tuesday, skimmed milk powder prices rose 6.6 percent. European goods are therefore barely competitive. However, the weakness of the euro in recent days has contributed to competitiveness.Feed qualities increased significantly at the Kempten listing. Whole milk powder was also traded more strongly in the market environment of rising raw material prices. Above all, short-term deliveries within the European internal market are traded. The global market is currently lacking competitiveness despite price increases in the Global Dairy Trade Tender on Tuesday. However, on the cash markets, whole milk powder is trading up to 100 euros/t higher than it was a week ago. Demand and availability of whey powder is also brisk. The price in Kempten rose by an average of 20 euros per ton to 790-860 euros/t.

ZMP Live Expert Opinion

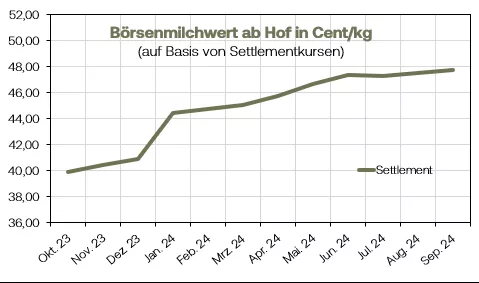

The milk market is stabilizing more and more. The price trends are firm, even if not all prices are increasing yet. From the producer's perspective, the basic payment prices in September are likely to remain unchanged, but there is clearly potential for the payment prices in the third quarter.