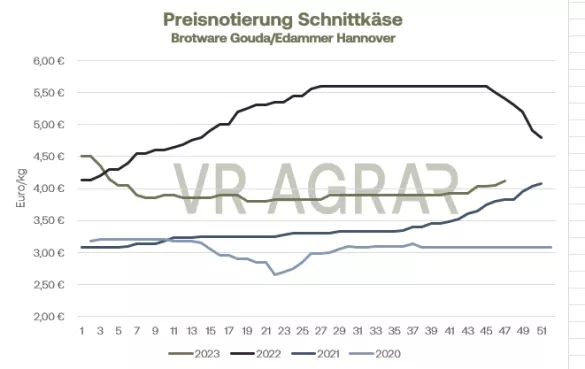

The amount of milk has recently increased slightly again. Compared to the previous week, around 0.6 percent more raw milk was registered at dairies in the 46th calendar week. However, compared to the 46th calendar week of the previous year, 2.2 percent fewer raw materials were tendered. Over the first 46 calendar weeks, the dairies had a total of 1.6 percent more milk available for use. Industrial cream continued its price rise this week. Skimmed milk and skimmed milk concentrate, on the other hand, continue to be traded unchanged without major price fluctuations. The sports market is stable to slightly firmer and is given a federal average of 45.3 cents/kg, which is 0.3 cents higher. Packaged butter is also very popular with consumers at the end of the month. Classically, demand peaks in the first week of December. Due to the contract, the dairy sales prices remain at the same level. It is reported that stocks of molded butter are now manageable. Not every additional request can be answered immediately. The listing in Kempten remains unchanged, as do consumer prices. The block butter market, however, remains calm.The goods issued are at the level that was to be expected based on the concluded contracts. Additional needs are rarely reported. Discussions are increasingly being held for deliveries in the new year up to and including the second quarter, but an agreement is currently rarely reached; buyers and sellers are often still far apart in their price expectations. Compared to our report last Thursday, butter prices on the EEX have fallen slightly, which also leads to slightly lower market milk values. The quotation on the Butter and Cheese Exchange in Kempten shows a firmer trend at the lower end of the trading range. The quotation commission in Hanover raised the prices for cheese (both bread and block goods) yesterday. A firmer trading margin is also noted for long-term deals. The outgoing goods from the rather limited stocks continue to be extensive. The food retail sector in particular is demanding large quantities and this high volume level is unlikely to change until Christmas. We are increasingly receiving inquiries from the classic holiday regions of southern Europe.Third countries are also inquiring, and all discussions show firmer price trends. The age structure in the Lägern remains young and overall there is a shortage of goods on offer despite high cheese production. There is hardly any movement in the skimmed milk powder. The price quotation remained unchanged for the third time in a row. There are hardly any short-term needs and the discussions that take place focus almost exclusively on the new year. The price level is also stable. The range of goods currently remains manageable. Dairies direct the milk quantities primarily into cheese production and only produce the quantities of skimmed milk powder that are already ordered. The export business remains manageable this week. Europe's manufacturers are increasingly feeling competition from cheaper offers from the USA and New Zealand. The quotations in Kempten for food grades and animal feed products remained unchanged yesterday. Trading on the EEX is quieter compared to the last few weeks. Prices here are under slight pressure to sell. Whole milk powder also remained unchanged from yesterday's listing meeting in Kempten.The volumes traded have increased slightly and slightly firmer price trends are reported from the European environment. Whole milk powder is currently produced primarily on the basis of orders; overproduction, which could end up in the warehouse and later put pressure on the market, is currently not produced. Whey powder is also in high demand in terms of quantity and is purchased both for short-term deliveries and for later dates. However, the listing in Kempten is inconsistent, similar to the price development on the market. The price was lowered at the lower end of the trading range and increased at the upper end.

ZMP Live Expert Opinion

Butter and cheese in particular are benefiting from good consumer demand. The powder markets, on the other hand, tend to continue to run smoothly and are likely to remain quiet for the time being. The better price situation is also reflected in firmer prices for milk producers. Many dairies have recently raised their prices and are often paying basic prices again at or above the 40 cent/kg mark.