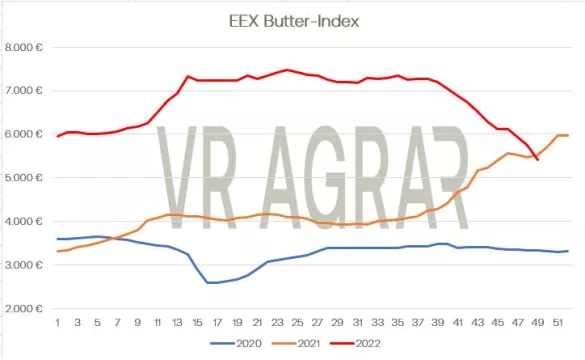

The amount of milk delivered continues to grow. For the year as a whole, the backlog has shrunk to 0.4% less milk in the last few weeks of delivery. Around 0.6% more raw milk was delivered compared to the previous week, and compared to the same week in 2021, the milk volume even increased by 3.6%. The concentrate markets were under price pressure due to the milk volume, which also increased seasonally. With sluggish demand, the cream prices have recently fallen significantly, skimmed milk concentrate is widely available, but due to weakening powder prices, the demand from the dryers is low. Spot market milk fell by a significant 5 cents per kilogram to 47.0 cents/kg. Manufacturers continue to be satisfied with demand for packaged butter , although calls are falling slightly just before Christmas. However, promotional prices in supermarkets support consumer demand. Promotional goods are available for EUR 1.99 per 250-gram packet, which is 30 cents cheaper than the current regular price for branded butter of EUR 2.29 per 250-gram. The molded butter prices were continued unchanged from the previous week in yesterday's listing.On the other hand, block butter is still under significant pressure to sell . Discussions about deliveries and business deals do take place, but they hardly ever materialize extensively. The buyer side expects prices to continue to fall and is therefore only ordering what is absolutely necessary. The export business also offers no significant impetus. At the butter and cheese exchange in Kempten, the trading range for block butter was corrected significantly downwards. With a quotation of 5.10 to 5.30 euros/kg, 54 cents were taken back at the lower end and 50 cents per kilogram at the upper end. Butter prices also fell on the EEX. For the second half of 2023, however, the participants on the EEX expect slightly firmer butter prices again. The course of business with skimmed milk powder continues to be calm. Demand is limited, but at the same time more than sufficient quantities are available. Concrete deals are mostly limited to January 2023.The world market is also very quiet at the moment, only Algeria is currently looking for larger quantities of skimmed milk powder with a tender, from which market participants hope that the European market will also be stimulated. Feed grades for skimmed milk powder are still only in demand to a limited extent. As with food quality, the trade margin was reduced again. The prices for whey powder have also weakened. Although prices are not falling as much as they were in November, limited demand is still putting pressure on prices, especially for feed-grade whey powder. The weaker trends in whole milk powder continued this week. The listing in Kempten was lowered yesterday by an average of 100 euros per ton. The business activities are also manageable here and are mainly limited to European industrial customers. Supply and demand in the cheese market are balanced. The orders from the food retail trade are at the typical seasonal level.However, a drop in access is expected around and after the public holidays. Due to existing contracts, the dairy sales prices remain largely unchanged compared to the food retail trade. At the level of industrial customers and bulk consumers, on the other hand, new contracts are at a lower level. Customers are currently only buying short-term requirements because buyers are speculating on price reductions in the overall weaker market for dairy products. In the export business, prices also fell slightly, so that the listing commission in Hanover corrected the trading range for block and bread products downwards. For block goods, the prices at the upper and lower end have fallen by 20 cents to 4.60 to 4.90 euros/kg, for bread products the quotation has fallen by 30 cents/kg to 4.70 to 5.10 euros/kg. In Kempten, on the other hand, prices for Emmentaler rose.

ZMP Live Expert Opinion

The dynamics of the price declines have recently slowed down. In the meantime, however, the recently good cheese business is also under price pressure due to bulk consumers' reluctance to buy. The dairy prices have recently been largely stable, but pressure is likely to come up here too in the new year.