Rapeseed was stable this week and, despite falling prices, closed yesterday, Thursday, at a price of 421.50 euros/t in the front month of May 2024. On Friday of the previous week, the shooting price was a marginal 0.25 euros per ton higher. Overall, rapeseed benefited from mostly friendly conditions from the crude oil sector this week. Better demand from oil mills also brought support. After the significant sales of the previous week, the view became more and more widespread that the correction was too severe and no longer corresponded to the real value of rapeseed, which is currently seen by many market participants in the range of around 420 euros/t. However, headwind for rapeseed came from the soy market, which fell significantly over the week. Canola is also under pressure at the ICE in Winnipeg. The previous week it had already fallen below the 600 Can dollar mark, with a closing price of 577 Can dollars/t a new three-year low was reached yesterday, Thursday. Due to the price setbacks and lack of bullish news for canola, Canada's farmers are currently offering their stocks extensively, further increasing the selling pressure.

Due to technical problems, the EU Commission, like last week, did not publish any fresh import figures for rapeseed this week. Overall, the supply situation in Europe appears to be sufficient overall. Things went south for soy on a weekly basis. The current harvest in Brazil is also a burden, as are the increased expectations in Argentina. In the middle of the week, the grain exchange in Rosario increased its estimate for the local harvest from 50 million tons to 52 million tons. Expectations are currently supported by current rainfall. The important Pampas region recently received between 40 and 100 mm of rainfall. In Brazil, the harvest continues to progress and producers are making faster progress compared to the previous year, despite individual weather interruptions. The voices that expect a harvest volume of less than 150 million tons of soybeans in Brazil are increasing. Soybeans were additionally burdened by the US Department of Agriculture's first estimate for the upcoming 2024/25 soybean harvest. Due to better yield expectations and higher acreage in the USA, USDA analysts are expecting a harvest of 122.4 million tons. This means that this year's good harvest is once again significantly exceeded. The values of previous years are also exceeded. The monthly processing figures from the US Oilseed Processors Association showed a lower processing volume in January compared to December. Analysts' estimates prior to publication were missed by a good 4.1%, but processors still processed around 3.8 percent more beans than in January 2023. Latent pressure also comes from last week's weak export figures.

ZMP Live Expert Opinion

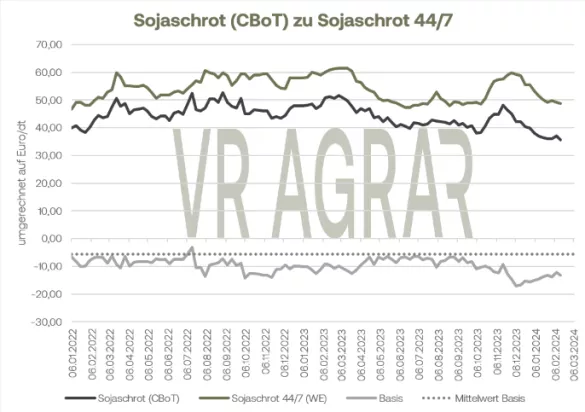

While rapeseed is trading almost unchanged for the week, the soy complex remains under pressure. Soybean meal, soybean oil and soybeans closed at lower prices for the week. The current harvest in the southern hemisphere is taking a toll. The fact that the USDA is now expecting an even higher harvest in the USA for 2024/25 is putting further pressure on prices.