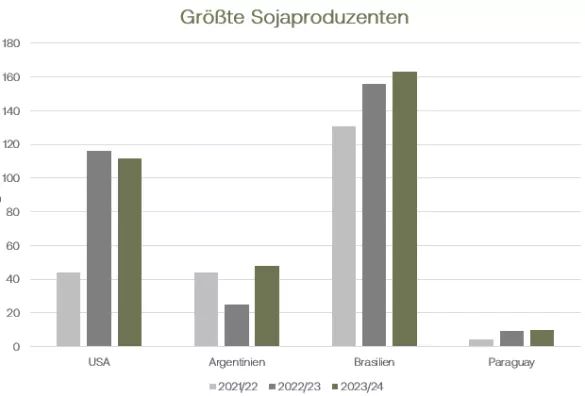

At the weekend, prices for rapeseed and soy will rise again on the two important stock exchanges. Overall, however, oilseeds have been under fire this week. While the most traded February contract on Euronext/Matif was still trading at 444 euros/t last Friday, at the closing bell yesterday it was still 432.50 euros/t. Today prices continue to rise. In the early afternoon, rapeseed is on the display board in Paris with a price of 441.25 euros/t in the most traded date in February. There were few surprises for rapeseed from yesterday's WASDE. The global harvest is still expected to be around 85 million tonnes, although there have been shifts in individual countries. The European harvest volume was revised upwards to 20.0 million tonnes, while the Ministry of Agriculture expects a harvest of 17.8 million tonnes for Canada. This means that the USDA is higher than the local authorities. The EU Commission only sees production of 19.6 million tonnes for Europe and the Canadian agricultural authority recently set a harvest target of 17.4 million tonnes.The fact that rapeseed fell overall over the week despite the increases on Thursday and today's Friday was primarily due to the difficult economic developments and the overall bearish market environment for vegetable oils. Crude oil prices have recently calmed down somewhat and the euro-dollar ratio has stabilized somewhat in favor of the Americans' competitiveness. The fact that pig prices are currently under pressure in Europe also means that feed prices are under pressure and therefore demand for rapeseed meal could be lower than previously expected. Rapeseed meal prices develop somewhat differently depending on the region and have most recently been under pressure due to the declining rapeseed prices. EU imports have recently increased slightly again, but are still noticeably below the previous year's level. According to many official estimates, Ukraine is likely to have a very satisfactory rapeseed harvest. The situation surrounding deliveries across the Black Sea was recently considered somewhat more relaxed. Soybeans were also under pressure over the week. Because of the strong dollar, Americans feared for their export opportunities.In addition, large quantities from Brazil are still available on the world market. Harvest pressure in the USA further reinforced the downward trend. The weather conditions are good and the harvesters can harvest the fields at full speed. After the publication of the October WASDE yesterday (6:00 p.m. CET), the soybean market went into a real price rally and this Friday, too, oilseeds are heading north on the CBoT. As expected, the USDA had noticeably revised US soybean production downwards. Instead of the previous 401.33 million tons of global soy harvest, 399.5 million tons are now expected. In the USA alone, the harvest was adjusted downwards by over 1 million tons. Production forecasts for Argentina and Brazil remained unchanged. Despite initial stocks being adjusted upwards, ending stocks of soy are also falling because consumption and exports are valued almost unchanged.

ZMP Live Expert Opinion

In the slipstream of the now rising soybean prices, the rapeseed prices on Euronext/Matif are also benefiting and will therefore also have an impact on the spot market prices. Global oilseed supplies are lower than last year, updated USDA figures have shown. Whether this can lead to a firmer price level remains to be seen. Because Brazil has brought in a record harvest and is expected to harvest more soy next year, the competitive situation remains high.