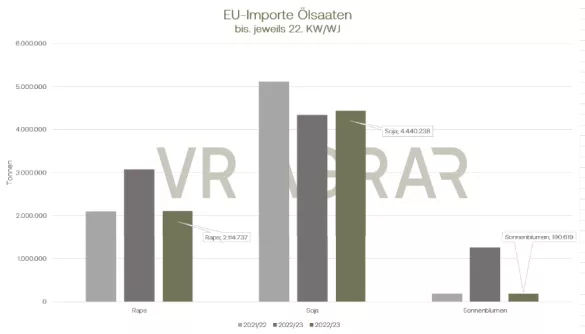

In the calendar month of November, which has now ended, rapeseed prices were able to increase despite high volatility. Yesterday the February contract closed at 450.75 euros/t, on November 1st it was still trading at 440.25 euros and rapeseed is also looking firmer as the week is now coming to an end. Trading remains manageable on the cash markets. At best, very short-term requirements are being traded, but the oil mills have mostly closed their books for 2023. Rapeseed meal sales prices were somewhat lighter over the course of the week. The federal average is 311 euros/t, in the previous week it was 316 euros/t and therefore 5 euros/t more. The Ministry of Agriculture in Canada expects production of 17.4 million tonnes this season. This is a harvest decline of 1.3 percent compared to the previous year. Since the processing figures are roughly at the same level as the previous year, exports are likely to correct slightly downwards. New figures for Canadian production are expected next Monday. In its November WASDE, the USDA saw the European harvest at 20.1 million tons. The EU Commission also raised its forecast slightly yesterday, but expects 19.86 million tonnes. This brings the harvest to around 300.000 tons larger than in the previous year and 15.15 percent higher than the average of the last five years. The EU's rapeseed imports are at a significantly lower level compared to the previous year. The soy complex also showed up this week. Driven by the difficult growing conditions in Brazil, production went north, especially at the beginning of the week and in the previous weeks. Since the weather situation has continued to improve and farmers in South America are making better progress with sowing, soybeans, soybean meal and also soybean oil were particularly under pressure on yesterday's trading day. Falling crude oil prices are also a burden. The first analysts have already reduced their forecasts for Brazil; the USDA had stuck to the previous result in its November WASDE, but could also make corrections in the coming week. US export shipments were particularly friendly this week. China in particular bought larger quantities in the USA, confirming rumors of a new shopping spree from the Middle Kingdom in the USA. The USDA was able to announce high export bookings via so-called flash sales several times this week. In contrast to beans, soybean meal fell over the week.This also led to cheaper soybean meal prices on the local cash markets. With the start of trading today, there are once again clearly red signs in the soy complex. Rapeseed also fell slightly in early trading this Friday.

ZMP Live Expert Opinion

The oilseed markets were able to end the trading week that is now coming to an end on a positive note. But due to the markets' growing focus on South America, the volatility of rapeseed and soy, which has been evident all year round, is likely to remain the same. China's demand is high, and growing conditions in Brazil are sometimes difficult. Nevertheless, production forecasts remain high.