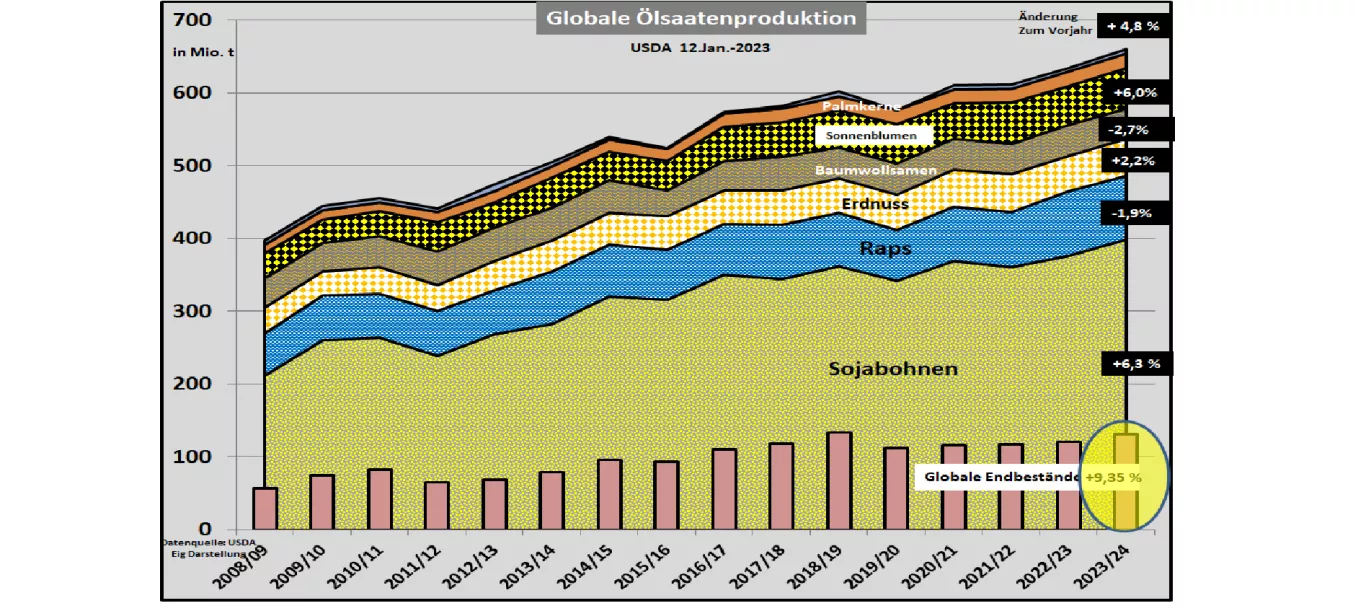

Oilseeds: status and prospects (1) IGC with soybean estimate: Despite a slight reduction in the previous month's estimate, the IGC's forecast of global soybean production of 392 million tonnes remains at a record level. The decisive factor is the Brazilian harvest that has just started with a slightly reduced estimate of 154 million t (previous month (160 million t). Argentine soy production is estimated at 48.5 million t (previous year 25 million t). The same as in the previous month The IGC reduces the higher estimated consumption to around 384 million t (-2.7 million t). The background is the reduced animal population. Accordingly, global stocks increase by around +15% to 66 million t. (2) USDA with Oilseed estimate with a focus on soy and rapeseed The USDA only slightly changes its January 2024 estimate for the entire oilseed market compared to the previous month. It remains at a record harvest of around 660 million.t and significantly increasing inventories of +9% compared to the previous year. At around 399 million tonnes, the soybean harvest plays the decisive role. The increase compared to the previous year is around +6.5% and is mainly due to the above-average soybean harvests in South America . Despite weather-related cuts, the USDA expects a Brazilian harvest of 157 million t (previous month 160 million t) and in Argentina of 50 million t (previous year 25 million t). The USDA estimates tend to be more optimistic than the comparable IGC forecasts. With regard to the foreseeable supply situation, the two forecasts are not far apart. The USDA is also increasing its slightly different ending inventory calculation by around 14.5%. Compared to the previous monthly production estimates, the global rapeseed market in 2023/24 is estimated to be slightly higher again at 87 million t (previous year 88.8 million t). Changes mainly resulted from upwardly revised harvests in the EU and Canada, while some reductions had to be made in Australia and Ukraine.palm oil production, which is crucial for the vegetable oil sector, to be largely unchanged at the previous month's level of 79.5 million t (previous year 77.6 million t). The feared harvest losses as a result of the El Niño weather are significantly more moderate in the two main growing regions of Indonesia and Malaysia, with 80% of the production. Although the rapeseed prices on the Paris Stock Exchange have been trending downward recently, they are still well above the long-term average of previous years before the pre-war period.

| Forward rates as of Jan 12, 2024 | Feb.24 | May-24th | Aug.-24 | November-24 |

| Rapeseed, Paris (in €/t) | 419.25 | 421.25 | 421.75 | 428.25 |

The forward rates indicate an increased price level in the further course of 2024.