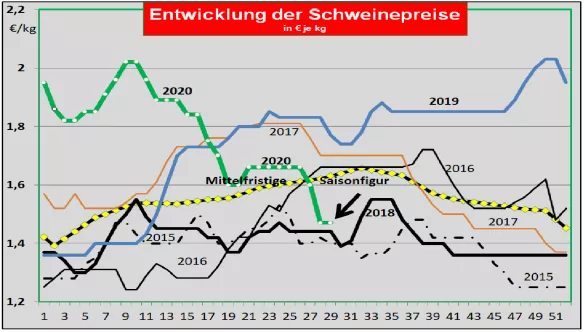

Pork market: Tönnies slaughterhouse is gradually reopening - prices stable at a low level Germany: Lack of slaughter capacity keeps the slaughter figures at a low level of 783,552. But the average carcass weights have increased to 97.3 kg. When the parts were resold to food retailers, processors and for export, the prices were reduced on average by -13 ct / kg last week. Obviously there is enough meat available despite the small numbers of slaughter. Weak domestic demand, falling exports to other EU countries and the lack of China sales have an impact. At 282,700, pre-registrations for the current week are not quite as large as in the last week, but are around 20% above the average of previous weeks. The V price for the 29th / 30th KW 2020 will remain unchanged at 1.47 € / kg .The range is given as 1.47 to 1.47 € / kg. The ASP cases in Eastern Europe increased significantly in the first half of 2020. Mecklenburg-Western Pomerania is building a fence on the Polish border. Market and price development in selected competing countries: Denmark has kept pig prices constant for the current week. The prices remain unchanged for the coming week. In Belgium , weak demand and a lack of live exports lead to sales problems. The already low prices are under pressure. The individual slaughter companies pay house prices. Netherlands: Prices remain stable at a low level. In France the range of living is limited. The slaughter weights have dropped by 2 kg. Decreased international vacations keep domestic demand higher than usual. Prices drop slightly by -1.1 ct / kg .In Italy , supply and demand have largely adjusted to one another. Imports from Germany start up again. Prices remain largely unchanged at a low level. In Spain , the live supply remains low due to the temperature. Deliveries from abroad are welcome. 50% of meat production is now exported, 30% of it to China. The living quotes show slight upward tendencies. In the USA , producer prices of € 0.58 / kg do not come out of the bottom. An unchanged high living supply of 7.5% over the previous year meets weak demand due to income. The persistently high export to China with roughly dismantled slaughter halves provides partial relief. In Brazil , the converted prices rose again to € 1.18 / kg. The weaker real slowed prices somewhat. Restrictions caused by the Covid 19 pandemic reappear, particularly in the southern provinces.Exports are benefiting from the weak real, rising China prices and the ban on the delivery of corona-laden slaughter companies. China: The prices rose further on average to € 5.80 / kg . In-house production reached its lowest point this year. After the Covid pandemic has been overcome, demand will rise again. Imports are expected to increase to 4.4 million tons of pork, almost 3 million tons of beef and 1 million tons of poultry meat at record levels. The U.S. Department of Agriculture is not expecting increasing self-sufficiency until 2021.

ZMP Live Expert Opinion

The justified expectations for increasing slaughter capacities are relieving, after all, the prices show no further downward trends. The hope is not unfounded that in "normal" slaughtering under corona conditions, the scarce living supply could lead to rising prices. To do this, however, demand at home and abroad must pick up again. The conditions are there.