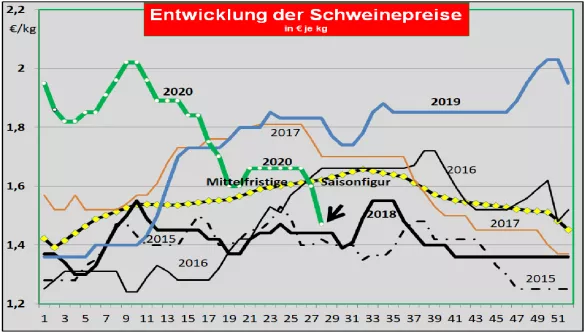

Pork market: anxious waiting for Tönnies slaughterhouse opening - 70,000 to 80,000 pigs in a traffic jam. Germany: Repeatedly low slaughter numbers in the previous week of 768,532 g are an average of 75,000 due to limited slaughter capacities below the level before the Tönnies closure. The slaughter weights have increased to 97.2 kg. When the parts were resold to food retailers, processors and for export, the prices were reduced on average by -6 ct / kg in the last week. Obviously there is enough meat available despite the smaller numbers of slaughter. Pre-registrations for the current week are 300,105, 70,000 higher than before the Tönnies closure. The backlog is becoming more dramatic. The V price for the 28th / 29th KW 2020 will be lowered by -13 ct / kg with € 1.47 / kg . The range extends from 1.47 to 1.50 € / kg.Tönnies exports in the EU single market are canceled. The third country business suffers from the Chinese import ban for several German and European suppliers. Despite Corona, one should not neglect the ASP risk. Market and price development in selected competing countries: Denmark has lowered pig prices for the current week by 4 ct / kg. A further 4 ct / kg price drop is expected for the coming week. In Belgium , both weak domestic consumption and the lack of live exports to Germany cause sales problems. The prices were reduced between -3 to -19 ct / kg. Netherlands: The backlog of pigs causes an average price drop of -8 ct / kg. Slaughter numbers and slaughter weights are falling in France . However, demand remains very subdued.The national holiday is next week. Prices tend to be weak. A brisk demand is reported in Italy , which is favored by the increasing number of holidaymakers. At the same time, the domestic supply is relatively small due to the lack of quantities and falling slaughter weights. Imports from Germany are also low. The prices continue to rise. In Spain , the live supply is falling due to the high heat (35 to 40 degrees). Tourism increases meat demand. On the other hand, export sales in the EU internal market are under pressure. China exports were canceled by cancellations. However, the living quotes show further upward tendencies. In the USA , producer prices of € 0.54 / kg do not bottom out. An unchanged high living supply with increasing slaughter weights meets weak demand due to income. The backwater is said to affect 1 million animals. The persistently high export to China with roughly dismantled slaughter halves provides partial relief. In Brazil , the converted prices rose again to € 1.03 / kg. In addition to the price increase in the domestic currency, the strengthened real also contributes to this. Restrictions caused by the Covid 19 pandemic reappear, particularly in the southern provinces. Not least, exports benefit from the weak real. China: Prices have continued to recover to € 5.56 / kg on average. In-house production will remain an additional 7.5% smaller this year. After the Covid pandemic has been overcome, demand will rise again. Other types of meat and protein carriers such as fish and milk only partially compensate for the deficit in pork. Imports will peak this year. The U.S. Department of Agriculture is not expecting self-sufficiency to increase again until 2021.

ZMP Live Expert Opinion

As the length of the slaughter increases, the living supply in the stables accumulates. Producer prices are falling. A gradual resumption of slaughtering means that the critical market situation will continue for a few weeks. There is hope that afterwards a low level of living offers will lead to reasonable prices with increasing demand from home and abroad.