Germany: prices at 1.42 € / kg - live supply remains small - demand even smaller The weekly slaughter numbers have risen again to 784,896 (previous week 767,208). The slaughter weights have fallen again at 96.1 kg (-0.1 kg). The pre-registrations have increased with 210,700 pigs (previous week 203,300 ), but remain at a well below average level. When reselling the pieces to food retailers, processors and for export, the average prices were reduced by a further -1 ct / kg. The neck alone gave way by –7 ct / kg. In the last 4 weeks, the decrease in the price per unit has totaled an average of -18 ct / kg . At the ISN auction on Tuesday, July 13th came with an offer of only 1.210 pigs a price of 1.45 € / kg (-4 ct / kg for the pre-auction). There was a 40% supernatant. The V price for the period from July 15th. until July 21st , 2021 the price will be reduced by € 1.42 / kg by -4 ct / kg. The range was reduced to 1.42 to 1.48 € / kg. As of July 13, 2021, 1,540 wild boars infected with ASF have been officially confirmed in Brandenburg and Saxony. The fence to the Brandenburg-Polish border has been completed. Market and price development in selected competing countries: In Denmark the prices have remained unchanged in the 28th week 2021. Exports of slaughter pigs to neighboring countries are declining due to their low attractiveness. In Belgium the prices are in the 28thKW remained unchanged at the low level of 1.25 € / kg. If domestic sales are balanced, exports remain unsatisfactory. Netherlands: In the majority of slaughterhouses continuing low prices were paid in the 28 KW; some companies have cut the rates by - 4 ct / kg. In France , prices in Brittany fell by a further -4 ct / kg to € 1.38 / kg . The decisive factor is the national holiday July 14th as the missing slaughter day. Nevertheless, the slaughter figures were 364,842 pigs, but with a slaughter weight of only 94.6 kg. In Italy the quotations in KW 28 have been set back by a further -2.3 ct / kg . Cheap import quantities put pressure on the courses. In Spain the prices were again reduced by another -5 ct / kg to just under 1.88 € / kg.Declining business in China in terms of volumes and prices is decisive. Sales in the EU internal market are only possible with considerable price concessions. In the USA , prices in IOWA rose temporarily to € 2.14 / kg after a brief price weakness. The quotes for the front month of July on the Chicago stock exchange also increased slightly to € 2.09 / kg. The scarce supply from ongoing slaughtering and cold store supplies is not enough for the barbecue demand . Already calculated for the month of August falling prices, which can fall to below 1.60 € / kg by autumn / winter. High cost prices and a strong dollar reduce competitiveness in the export business. Brazil: After a previous decline, producer prices have stabilized again at 1.30 € / kg. The weaker currency also contributed to this.The restrained domestic demand and falling sales revenues from China exports prevent further upside potential. China: The price decline passed the price valley with 2.37 in the previous week. The latest price is the equivalent of € 2.77 / kg . Discontinued panic sales by the fatteners and government support purchases contributed to the price recovery. For Sep-2021 , futures prices are again being traded on the Dalian Stock Exchange, rising from € 2.90 to € 3.28 / kg . It is still unclear to what extent the rebuilding of the pig population has been damaged. Conclusion: slightly increasing slaughter numbers and advance registrations gave sufficient reason to lower producer prices in the difficult meat sales situation. Unfavorable barbecue weather and the start of holidays in some federal states limit demand.

ZMP Live Expert Opinion

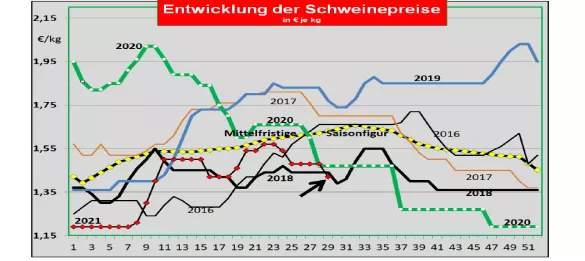

Because of the increasingly limited sales opportunities in third country business, too much meat is pushing its way onto the EU internal market. Unfavorable barbecue weather and the holiday / vacation season put pressure on demand. In this market situation, slight increases in supply are sufficient to lower prices. Nevertheless, the number of slaughters - measured against previous years - is well below the average. A seasonal summer price high is not in sight.