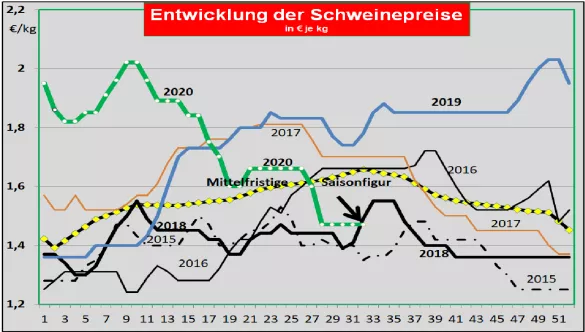

Further improvements in the market situation are evident. Germany: The previous week's slaughter figures have already reached 854,403 pigs, a total of around 10% above the average for the previous weeks. But the average slaughter weights of 97.9 kg indicate that the supply backlog has not yet been completely overcome. When reselling the cuts to food retailers, processors and for export, the rates in the most recent period at -1 ct / kg were not quite maintained after the sharp rise in prices in the previous weeks. The export business is gaining momentum again. The pre-registrations for the current week fell again with 257,400 compared to the previous week. We are slowly approaching the seasonal range of 225,000 to 235,000. The V price for the 32nd / 33rd KW 2020 will remain unchanged at 1.47 € / kg .The range also remains unchanged at 1.47 to 1.47 € / kg. The ASF cases in Poland are threateningly high. Another case near the German border. Market and price development in selected competing countries: Denmark has kept pork prices constant for the current week. There is a chance of a slight price increase for the coming week. In Belgium sales of pork are increasing. Domestic consumption is picking up. Demand is also coming from Eastern Europe, especially Poland. The prices were increased by 2 ct / kg. Netherlands: The sales market is moving, deliveries to Spain relieve the local market. The prices rose by 1 ct / kg on average. Further price increase potential is not excluded. In France there is a limited supply of approx. 380000 in the northeast with stable slaughter weights of around 95 kg. Prices in Brittany will remain stable for the time being. In Italy the supply lags behind the demand. Imports from Germany are picking up again. Prices are expected to rise by a further 4 to 5 ct / kg. In Spain the domestic live supply is insufficient for the demand. The Netherlands is helping out with an increasing meat supply. Business in China is going well. In the meantime, 50% of meat production is exported, 30% of it to China. The overall balanced relationship between meat supply and demand keeps prices in check for the time being. In the USA , the increased prices could not hold up and slipped back to € 0.76 / kg. Seasonally low supply quantities and slaughter weights have bottomed out. The cold store stocks show an upward trend again. The barbecue season is at its peak.Despite political tensions and Chinese punitive tariffs, China exports continue to move at an astonishingly high level with roughly cut slaughterhouses. In Brazil , the converted prices were not quite able to maintain the elevated level of 1.35 € / kg. The decisive factor is the loss in value of the REAL. Despite a few banned companies, business in China is in full swing. 440,000 tons of pork were exported in the first half of the year, half of it to China. China: Prices have fallen slightly on average to € 6.10 / kg . The high price level dampens the income-based high demand. Pork imports in the first half of 2020 doubled to 3 million tons of product weight compared to the previous year. More than half of them come from the EU. The first successes in increasing self-generation are not expected before 2021.

ZMP Live Expert Opinion

Despite the fact that German quotations remained unchanged for weeks, a range of information points to a clear easing of the market situation. But there is still a supply backlog to be processed. Price increases have already occurred in a number of EU member states.