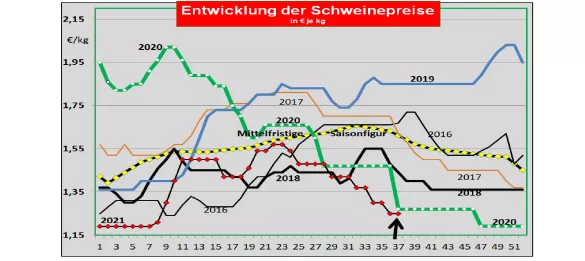

Germany: V- price unchanged at 1.25 € / kg - upper range deleted. The weekly slaughter figures have decreased slightly to 818,452 (previous week 828,496), the slaughter weights are slightly higher at 96.9 kg. Compared to previous years, the cold store stocks in July 21 were around 100,000 t higher. The pre-registrations have increased somewhat to 274,600 pigs (previous week 270,550 ), but remain below average compared to previous years. When reselling the pieces to food retailers, processors and for export, the average prices were set back by -3 ct / kg , in the case of Nacken it was -5 ct / kg. At the ISN auction on Tuesday, August 31sta price of 1.29 € 7kg came about with an offer of 882 pigs. There was a supernatant of 54%. The V price is for the period from 09.09. until 15.09.2021 with 1.25 € / kg The range extends from 1.25 to 1.25 € / kg. As of September 7th, 2021, 2,073 wild boars infected with ASF have been officially confirmed in Brandenburg and Saxony. Domestic pigs are not affected. Market and price development in selected competing countries: In Denmark the prices fell by around -3 ct / kg in the 36th week of 2021. A lower piglet export leads to an increased supply of slaughter pigs domestically. The export business remains weak. In Belgium the prices fell by -7 ct / kg in week 36.The inadequate export leads to increased domestic supply pressure. Netherlands: After an unchanged previous week listing, the prices in the 36th week have been set back by -3 ct / kg. In France / Brittany , prices were reduced slightly by -0.3 ct / kg to 1.34 € / kg . The number of slaughtered pigs rose slightly to 371,497 pigs, as did the slaughter weights. In Italy the quotations in week 36 have remained unchanged. With the end of the vacation period, the demand decreases. Imports are entering the market. Spanish deliveries are cheap. In Spain the prices were again reduced by -2 ct / kg in the 3rd week. The price decrease in one month adds up to around 35 ct / kg and is the equivalent of 1.56 € / kg. The expiring vacation period and lower export revenues are putting the market under pressure.In the USA / IOWA , prices fell to 1.76 € / kg due to the holiday. On the Chicago stock exchange , the prices for the front month Oct. 21 fell to 1.67 € / kg . In the subsequent months, however, the level is only 1.55 € / kg. Below-average stocks in the cold stores prevent further price drops. Brazil: Producer prices fell further to € 1.29 / kg. Domestic prices are falling; the real remains stable. The export business to China is 65%, but the revenues are falling. Nevertheless, Brazilian production remains on an expansion course. China: The latest prices have fallen to € 2.60 / kg.For Sep-2021 , futures prices of "only" € 2.40 / kg will be traded on the Dalian Stock Exchange. For fear of further price drops, the spread of animal diseases and high feed prices, fattening pigs are sold underweight and breeding sows are slaughtered. The state helps with support purchases. Conclusion: Persistently high slaughter numbers, slaughter weights and advance registrations as well as high stocks of cold stores push producer prices down if the sales situation continues. In the EU internal market, the reduced exports from China, Denmark and Holland are leading to increased supply pressure. Only muted hopes are directed towards better (barbecue) weather and the end of the holiday / vacation in some federal states. A recovery from the pre-Christmas business is still a long way off.

ZMP Live Expert Opinion

If the degree of self-sufficiency is well above 100%, it depends on the third country export. However, due to ASP and China's declining import volumes at falling prices, this is currently completely inadequate. The usual seasonal increase in live supply at the end of the summer period leads to considerable price pressure in such a market situation, which will continue for some time. The expectations of improvements from the pre-Christmas business are still a long way off.