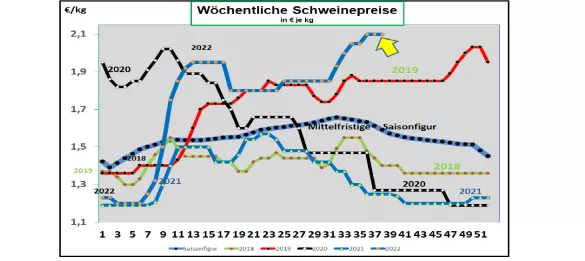

Germany: V price 2.10 €/kg (range 2.10 – 2.10 €/kg) - the weekly slaughter figures are still well below average with 741,234 pigs ( previous week 739,206) ; the slaughter weights were slightly increased at 96.8 kg The pre- registrations remain largely unchanged at around 252,400 pigs (previous week 252,000 ) at a low level. Increases in supply are expected in the near future.When reselling the cuts to food retailers, processors and for export, the average prices were reduced to €2.44/kg. Stomach, shoulder and neck all gave way. At the ISN auction on Tue, Sep 20 In 2022 , an average price of €2.13/kg was achieved with a range of €2.10 to €2.16/kg. The V price for the period from 09/22/2022 to 09/28/2022 remained at €2.10/kg; the range is between 2.10 and 2.10 €/kg. ASP : As of 16.Sep. In 2022, 4,310 wild boar infected with ASF were officially confirmed in Brandenburg, Saxony and Mecklenburg. A shortening of the deadline in the Emsbüren observation area was approved by the EU COM. But slaughter is stopped. Who takes the meat? Market and price development in selected competitor countries: In Denmark , prices are in the 38thKW 2022 remained unchanged at a comparable €1.86/kg. Sales revenues for meat and sausage products are stagnating. In Belgium , the prices in the 38th week of 2022 will remain unchanged. Selling carcasses in the eastern EU countries is becoming increasingly difficult. In the Netherlands , the prices in the 38th week remained at a comparable €1.92/kg . In France/Brittany , prices rose slightly to around €2.44/kg . The battle figures are still at a low level with 363,056 pieces. Battle weights unchanged. In Italy , the listings in the 38th week of 2022 rose again by 1 ct/kg . Despite the end of the holiday season, the low supply of livestock remains very tight for demand. In Spain , the prices in the 38th week of 2022 remained unchanged at a comparable €2.26/ kg. When temperatures drop, the supply of life increases.Nevertheless, the slaughter capacities are not fully utilized. In the USA/IOWA , prices have stabilized again at the equivalent of € 2.15 /kg . Increased part prices provide a boost. For the front month Oct.-2022, the forward rates are quoted at €2.12/kg . For the December 22 date, however, the stock market prices are only €1.94/kg . The mood has brightened compared to the previous weeks. Brazil: On average, producer prices have fallen further to €1.65/kg while REAL has weakened. Weak consumer incomes lead to subdued demand and a reorientation to the increased and inexpensive chicken meat supply. A moderate increase in production is expected for 2023, with increases in exports to China, South Korea, Vietnam and Thailand. China: Prices rise to the equivalent of € 4.38/kg. The exchange rate has strengthened again.The futures rates on the Dalian Stock Exchange are traded lower in Jan-2023 at €4.26/kg than in the previous weeks. Conclusion: In the post-holiday phase, demand is usually reserved. The increase in consumer prices will exacerbate this development this year. The part prices have been on the spot for 4 weeks. The low live supply remains the only effective price support. Prices are also stagnating in the other EU member states.

ZMP Live Expert Opinion

For weeks, stagnant to slightly declining prices for parts when passed on to the food retail trade signal a limited interest in meat sales. Consumer demand is very low. The price stability is mainly achieved by the low live supply, but it is shaky. Hopes are pinned on depleted stocks in cold stores.