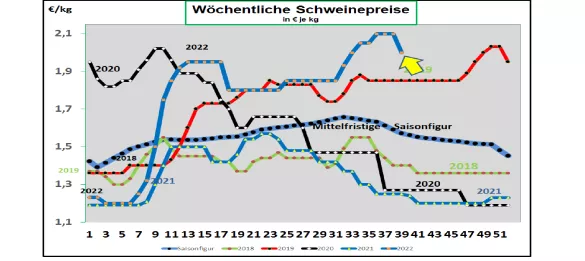

Germany: V price 2.00 €/kg (range 2.00 - 2.10 €/kg) - The weekly slaughter figures have increased slightly to 953,420 pigs ( previous week 741,234) . below average; the slaughter weights were slightly increased at 96.8 kg The pre- registrations remain largely unchanged at around 250,000 pigs (previous week 252,400 ) at a low level. Increases in supply are expected in the near future.When reselling the cuts to food retailers, processors and for export, the average prices were reduced to €2.44/kg. Stomach, shoulder and neck all gave way. At the ISN auction on Tue, Sep 27 In 2022 , no pig was sold again. The V price has fallen to €2.00/kg for the period from September 29, 2022 to October 5, 2022; the range is between 2.00 and 2.10 €/kg. ASP : As of 26.Sep. In 2022, 4,326 wild boar infected with ASF were officially confirmed in Brandenburg, Saxony and Mecklenburg. Pigs from the Emsbüren observation area can be slaughtered from October 5th. It is about 40,000 partially overweight animals. Market and price development in selected competitor countries: In Denmark , the prices in the 39th week of 2022 changed insignificantly at a comparable €1.86/kg. The supply pressure is easing.In Belgium , the prices in the 39th week of 2022 will be reduced by - 2 ct/kg . Selling carcasses in the eastern EU countries is becoming increasingly difficult. In the Netherlands , the prices in the 39th week remained at a comparable €1.92/kg . In France/Brittany , prices rose slightly to around €2.45/kg . The battle figures are still at a low level with 362,648 pieces. Battle weights have increased slightly. In Italy , the listings in the 39th week of 2022 rose again by 1.7 ct/kg . The living supply remains scarce for the demand. Overweight pigs from Emsbüren could help. In Spain , the prices in the 39th week of 2022 repeatedly stopped at a comparable €2.26/ kg. When temperatures drop, the supply of life increases. Nevertheless, the slaughter capacities are not fully utilized.In the USA/IOWA , prices have stabilized at the equivalent of € 2.15 /kg . Increased part prices provide a boost. For the front month Oct.-2022, the forward rates are quoted at €2.05/kg . For the December 22 date, however, the stock market prices are only €1.80/kg . The mood has settled compared to the previous weeks. In the first half of the year, rising prices are traded again. Brazil: On average, producer prices have increased slightly to €1.66/kg while REAL has become stronger. In local currency, the courses in the high-price provinces have fallen. Weak consumer incomes slow demand; A large and inexpensive chicken meat offer lures. Falling feed prices improve prospects for 2023 . China: Prices rise to the equivalent of € 4.49/kg. The exchange rate has strengthened again. Forward rates on the Dalian Stock Exchange will be in Jan.-2023 traded at 4.26 €/kg lower than in the previous weeks. Conclusion: The weak demand in the post-holiday phase is exacerbated by increased consumer prices. Part prices have recently tended to decline. The autumn holidays in large federal states weaken sales opportunities. The low live supply may be the only effective price support, but slaughter numbers are rising. Prices are stagnating in the other EU member states

ZMP Live Expert Opinion

Weak demand leads to falling part prices. Autumn holidays also slow down sales. The increased living supply comes at the wrong time. The prospects for the next few weeks are not very encouraging.