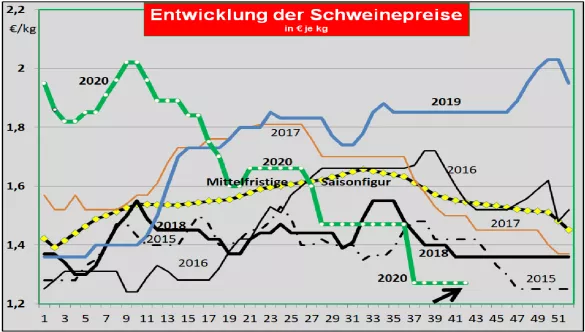

Germany: The supply pressure continues to rise. Prices unchanged. The slaughter numbers of the previous week increased slightly to 811,752 (previous week 790,424), the slaughter weights are already 98.4 kg. The pre-registrations for the current week remain at a high level at 302,900 (previous week 302,400) and signal an increasing supply backlog. Unlike in summer, the usual seasonal increase in supply exacerbates the problem. When reselling the pieces to food retailers, processors and for export, the average prices were raised by 2 ct / kg . Chop, ham and shoulder are getting bigger . Other parts are more difficult to place in the market. The export business has collapsed due to the ASP-related bans on Asian importing countries. One problem is the accommodation of the parts typical of third country exports. The V price remains for the 42nd / 43rd. KW 2020 stand at 1.27 € / kg. So far 65 wild boars infected with ASF have been detected in the extended area in Brandenburg. The area of 150 square kilometers is fenced. The most recent ASP find was discovered on an island in the Oder. This is a whole pack, 17 animals had already died, others were visibly sick. A fence is being drawn. Market and price development in selected competing countries: In Denmark the prices in week 42 will remain unchanged. Deliveries to Germany are under pressure to sell. Third country exports bring some relief. Coronavirus and an impending hard Brexit restrict exports to Great Britain. In Belgium the prices in KW 42 remained unchanged with one exception.The sales opportunities in the EU internal market are more difficult for Germany because of the ASP-related export ban. Netherlands: The different high prices of the individual slaughterhouses remained unchanged. Live exports to Germany have fallen by 40%. In France slaughter numbers (377,000) and slaughter weights (94.8 kg) rose again. The prices in Brittany were set back somewhat at 1.36 € / kg . Imports from neighboring countries narrow the sales and price scope. In Italy , the price level reached so far can only just hold up . More and more inexpensive cuts come from abroad. In Spain the prices remain stable at the equivalent of 1.72 € / kg. The comparatively high price level attracts offers from the surplus countries. China exports are going well. In the USA , producer prices in IOWA have fallen back to 1.20 € / kg . An increasing live supply meets coronavirus-related limited slaughter capacities. Nevertheless, the Oct date is traded at € 1.46 / kg on the Chicago Stock Exchange. The fluctuating dollar plays a role in this. The pig count on Sep 1 delivered surprisingly increasing numbers of pigs, but falling numbers of sows. The cold store stocks are below the previous year's level. In Brazil , prices rose to 1.61 € / kg due to currency effects . In the local currency, prices are at record levels. Here, too, one benefits from growing export business because of the ASP delivery blocks for Germany. China: The prices are converted at approx. 5.89 € / kg remained. The fluctuating exchange rates play a role in the conversion. The blocked German deliveries are offset by replacement imports from other countries.A slight increase in domestic supply is noticeable.

ZMP Live Expert Opinion

Finished fattening pigs accumulate in front of the limited slaughter capacities. Piglets cannot be moved to the required extent. Here, too, a backlog. In contrast to summer, the usual seasonal increase in supply in the live cattle sector has to be coped with. In contrast, the fresh meat offer is not too plentiful. Rising prices indicate brisk sales of the price-determining valuable parts. But what to do with the others? . .. The appropriate third country sales are missing because of the ASP-related locks. There are no convincing arguments for either falling or rising producer prices.