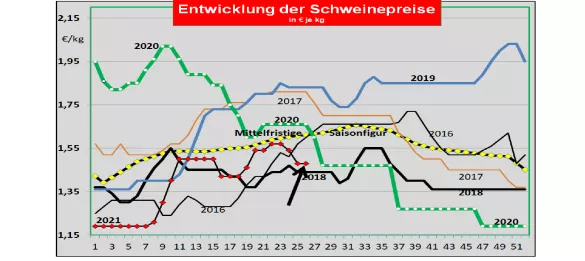

Germany: Supply pressure on the EU meat market - prices unchanged at 1.48 € / kg. The weekly battle figures are 855,337 (previous week 869,451, previous week 803,474), still in the good midfield . The slaughter weights have fallen to 96.7 kg (-0.6 kg). The pre-registrations are still at a low level at 204,100 (previous week 209,500 , previous week 209,900). When reselling the pieces to food retailers, processors and for export, the average prices were reduced by -9 ct / kg. Chop yielded - 11 ct / kg. Ham heel is weak. At the ISN auction on Tuesday, June 22nd. came out with an offer of only 795 pigs a price of 1.51 € / kg (-4 ct / kg at the pre-auction). There was no overhang. The V price for the period from June 24th. until 30.06.2021 will be maintained at 1.48 € / kg. The range is from 1.48 to 1.50 € / kg. As of June 22, 2021, 1,368 wild boars infected with ASF have been officially confirmed in Brandenburg and Saxony. Market and price development in selected competing countries: In Denmark the prices were set back by -8 ct / kg in the 25th week 2021. The declining business in China is increasingly directing the flow of goods into the EU internal market. In Belgium the prices in the 25th week fell by -8 ct / kg . The lack of live exports is depressing the domestic market. Netherlands: In most slaughterhouses, in the 25thKW paid -7 ct / kg lower prices. In France , prices in Brittany fell slightly by -1 ct / kg to € 1.54 / kg. Persistently high battle figures are increasingly being met by cheap imports from EU surplus regions. In Italy the prices rose by +2 ct / kg in the 25th week. The holiday season triggers demand impulses. However, rising imports limit the price scope. In Spain the prices in the 25th week were reduced by -1 ct / kg to the equivalent of just over 2.0 € / kg. With declining sales in China, the meat supply is pushing its way into the EU internal market. The high cost prices hamper competitiveness. In the USA , the prices in IOWA have risen again to the equivalent of € 2.44 / kg .However, the quotes for the new front month of July on the Chicago Stock Exchange fall to 1.95 € / kg . The latest inventory report on cold store stocks indicates a 1% improvement on the previous month, but remains 1% below the same month last year. The total US meat stocks are 6% below the same month last year. Brazil: Producer prices have stabilized again at 1.63 € / kg. The stronger currency also contributed to this. Domestic demand remains subdued due to income. Falling sales revenues from China exports are offset by increases in exports to other import areas. China: The price decline continues to the equivalent of € 2.78 / kg . From one month it was around 5 € / kg. The demand has decreased significantly. In return, increasing domestic production and growing imports ensure sufficient supply.For Sep-2021 , futures prices will only be traded at € 3.0 / kg on the Dalian stock exchange. Conclusion: Low slaughter numbers and slaughter weights prevent producer prices from falling further. Low pre-registrations continue to signal a limited supply of life. The support from barbecue activities, European football championships and less restricted gastronomy could be greater. Declining exports to China (volumes and prices) are overshadowing the price-increasing effects. The shortfall in export volumes is putting pressure on the meat market in the EU.

ZMP Live Expert Opinion

A low live supply can only with difficulty compensate for the supply pressure in the meat sector. The cause is the dwindling sales in China. There is a lack of sufficient follow-up orders and willingness to pay on the Chinese side.