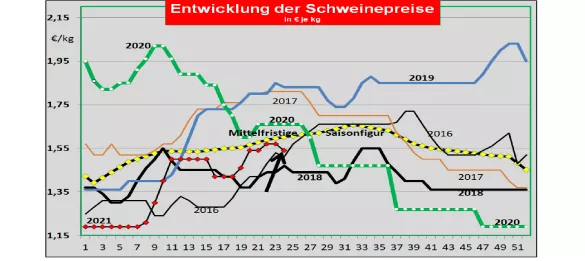

Germany: Supply pressure on the meat market - prices set back to 1.48 € / kg. The weekly battle figures are again in the upper average with 869,451 (previous week 803,474, previous week 758,955). The slaughter weights have fallen slightly to 97.2 kg. The pre-registrations are still at a low level of 209,500 (previous week 209,900, previous week 214,800). When reselling the pieces to food retailers, processors and for export, the average prices were reduced by -3 ct / kg. The cutlet even gave in by - 4 ct / kg. At the ISN auction on Tuesday, June 15 came out with an offer of only 1,055 pigs a price of 1.60 € / kg (-3 ct / kg at the pre-auction). There was a supernatant of 54%. The V price for the period from June 17th. until 23.06.2021 will be reduced considerably to 1.48 € / kg. The range is from 1.48 to 1.50 € / kg. Market and price development in selected competing countries: In Denmark the prices remained unchanged in the 24th week 2021. The declining business in China is increasingly directing the flow of goods into the EU internal market. In Belgium the prices in KW 24 remained unchanged . The Belgian price level remains comparatively low. Netherlands: The prices were kept unchanged in most slaughterhouses in week 24. A company pays 3 ct / kg less.In France , prices in Brittany remained unchanged at € 1.55 / kg . Increased slaughter numbers with unchanged slaughter weights increasingly meet cheap imports from surplus regions. In Italy , the quotations in KW 24 have been kept unchanged. Imports from Spain are putting the prices under pressure. In Spain the prices were raised in the 24th week by a further +0.5 ct / kg to the equivalent of around 2.04 € / kg . Decreasing slaughter weights in the warm season reduce the meat supply. However, business in China is declining. Overhangs are dumped in the EU internal market. In the USA , the prices in IOWA have risen again to the equivalent of € 2.38 / kg . However, the quotations for the new front month of July on the Chicago Stock Exchange remain at € 2.15 / kg .A currently increasing demand for barbecue meets seasonally low slaughter numbers and falling slaughter weights. The cold store stocks are being reduced more and more. Brazil: After the rapid drop in prices, producer prices have stabilized again at € 1.51 / kg. Domestic demand remains weak due to income. Falling revenues from China exports are offset by increases in exports to other import areas. High feed costs slow down the increase in production. China: The price decline continues. The prices are converted at € 2.99 / kg . From one month it was around 5 € / kg. The demand has decreased significantly. In return, increasing domestic production and growing imports ensure sufficient supply. For Sep-2021 , futures prices will only be traded at € 3.23 / kg on the Dalian Stock Exchange.Conclusion: The slaughter pig market is determined on the one hand by a short supply of slaughter pigs with yielding slaughter weights. Low pre-registrations indicate that the number of animals will continue to be limited. The increasing number of openings in gastronomy and the increase in barbecue activities due to the weather should actually generate more demand. But : The falling exports to China (quantities and prices) are directing excess goods into the EU internal market. Increasing amounts of meat in this country are putting pressure on the cut prices.

ZMP Live Expert Opinion

A price decline of 9 ct / kg in the middle of the barbecue season and increasing opening of the catering industry is a rarity. But the volume and price-related decline in sales to China is forcing the EU exporting countries (including Spain, Denmark, Holland and Germany, due to ASP), to divert the goods to the EU internal market. The increasing meat supply in the EU is overwhelming the high seasonal demand. The reduced unit prices are proof of this. High expectations with regard to price stabilization are attached to the persistently low battle figures in this country.