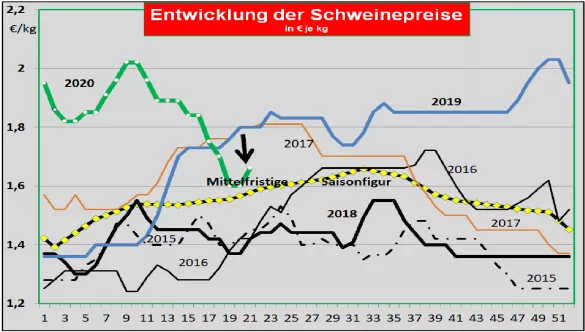

Pork market: strong price recovery to 1.66 ct / kg Germany: The number of slaughter in the previous week was good at 895,583. The slaughter weights remained unchanged at 97.1 kg. Pre-registrations for the current week have remained almost unchanged at 243,600. As a rule, around 900,000 slaughterings are expected. The Covid-related restrictions on slaughter capacity could obviously be compensated. When reselling the sections of food retailers, processors and export prices were raised kg ct in the last week by 1 /. Grill items in particular were paid higher. The V-price for the 21./22. KW 2020 was raised to 1.66 € / kg. The range is from 1.60 to 1.66 € / kg. The meat sales increase after the loosening in the catering sector and on the occasion of barbecue activities.Third country business with a focus on China is only slowly increasing again. Export prices are under pressure from competitors from overseas. The ongoing ASP threat remains in the background. Market and price developments in selected competing countries: Denmark has kept pig prices constant over the past week. Moderate price increases are expected for the coming full week. The market in Belgium is beginning to stabilize. Domestic sales are revitalized by an increasing demand for barbecue items. The prices are to be raised moderately in the coming week. In France , slaughter capacity is reduced due to the corona and the holiday. The living offer is not easy to accommodate. The sales situation in the meat business remains critical. Producer prices are still under pressure.In Italy , despite the occasional easing of the catastrophe situation, slaughtering and processing capacities remain reduced. The pent-up live supply leads to high slaughter weights. The ham trade remains unsatisfactory. The relaxed out-of-home consumption hardly noticeably increases sales. The price pressure remains. The situation has eased somewhat in Spain , but remains critical. The slaughtering and processing capacities are limited due to the protective measures. Domestic sales are feeling the first impetus. The export quantities increase only slightly and at less favorable price conditions. The living quotes should give way again slightly. In the USA-IOWA , producer prices have stabilized further after the sharp drop in prices to € 0.75 / kg. Two slaughterhouses are still closed, 7 others are restricted. Emergency killings of pigs are avoided. However, sow slaughter is above the previous year's level. According to the latest USDA estimates, pork production should stop growing this year.Exports are significantly below the increased level of the first quarter. In Brazil , the converted prices have stabilized further at € 0.91 / kg. The main cause is the scarcely available quantities of meat. The slaughter companies control production depending on the sales situation. The export volumes also suffer from the pandemic, but are kept up to date as far as possible. Export prices are under pressure from cheap competition from the United States. China: On average, prices fell further to € 5.53 / kg. Increasing imports of meat of all kinds and the switch to other protein carriers such as fish and milk products as well as a low-meat diet are reducing demand. The high prices and reduced income also reduce consumption. The intended reconstruction of the pig herd is delayed by the Covid pandemic. Meat imports will continue to increase in 2020.

ZMP Live Expert Opinion

A trend reversal has started. Sales revival due to easing in the catering sector and the increasing demand for barbecued items increase meat and producer prices. The living offer remains below average. The restrictions on slaughter, processing and delivery prove to be overcome. Support comes from third country exports. Trade in the internal market remains below average.