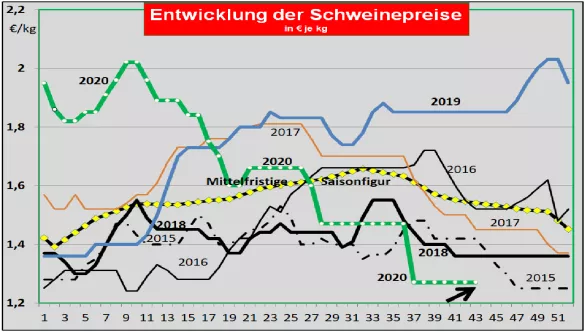

Germany: The living supply continues to increase. Prices unchanged. The slaughter numbers of the previous week rose again to 822,685 (previous week 811752), the slaughter weights are already 98.6 kg . The pre-registrations for the current week have risen considerably to 362,600 (previous week 302,900) and signal a growing supply backlog. Limited slaughter capacities and a seasonal increase in supply in the fourth quarter exacerbate the surplus problem. The creation of additional slaughter capacities on weekends and holidays is becoming more urgent. When reselling the pieces to food retailers, processors and for export, the average prices were kept unchanged. Shoulder and chop were rated slightly lower. The meat trade is stable. Slaughter by-products are more difficult to find in the market.The export business has collapsed due to the ASP-related bans on Asian importing countries. One problem is the accommodation of the parts typical for third country exports. The V price remains for the 43rd / 44th. KW 2020 stand at 1.27 € / kg. So far, 70 wild boars infected with ASF have been officially confirmed in Brandenburg. The restriction areas are fenced off. The search for fallen game with drones, dogs and firefighters continues. Market and price development in selected competing countries : In Denmark , prices in week 43 will once again be unchanged. Deliveries to Germany are difficult. In addition to Covid-related sales difficulties, exports to Great Britain encounter reservations about a no-deal Brexit. Third country exports bring some relief. In Belgium the prices remained unchanged in week 43.The sales opportunities in the EU internal market are more difficult for Germany because of the ASP-related export ban. Netherlands: The different high prices of the individual slaughterhouses remained unchanged. Live exports to Germany have fallen by 40%. In France slaughter numbers (376,500) fell slightly and slaughter weights (95.1 kg) rose again. The prices in Brittany were set back somewhat at 1.36 € / kg . Imports from neighboring countries narrow the sales and price scope. In Italy the prices have increased by 2 ct to approx. 1.55 € / kg dropped. Own generation and increasing imports are sufficient to supply the market. In Spain , prices remain stable at just under € 1.72 / kg. The comparatively high price level attracts offers from the surplus countries. China exports are going well. In the USA , producer prices in IOWA have remained at 1.20 € / kg . The new front month of Dec 2020 is only traded at 1.35 € / kg on the Chicago Stock Exchange. The fluctuating dollar plays a role in this. An increasing live supply meets coronavirus-related limited slaughter capacities. In Brazil , with the support of the currency, prices rose to 1.69 € / kg . In the local currency, prices are at record levels. Here, too, one benefits from growing export business because of the ASP delivery blocks for Germany. China: The average prices are converted to approx. 5.55 € / kg liked. The blocked German deliveries are offset by replacement imports from other countries. A slight increase in domestic supply is noticeable.

ZMP Live Expert Opinion

With 363,000 pigs or + 12.5% compared to the previous week, the pre-registrations are taking on threatening proportions. In earlier times this amount could have been accommodated in the slaughterhouses and cutting plants. But the current restrictions on the use of personnel in the slaughter industry have reduced capacities considerably. It's getting tighter. In contrast, the meat business is on a balanced path. Usually more processed goods are asked for in the season. In the export countries outside of Germany, the brisk China export helps a little. However, the rising second wave of coronavirus infections is worrying. The risk of a no-deal Brexit is increasing.