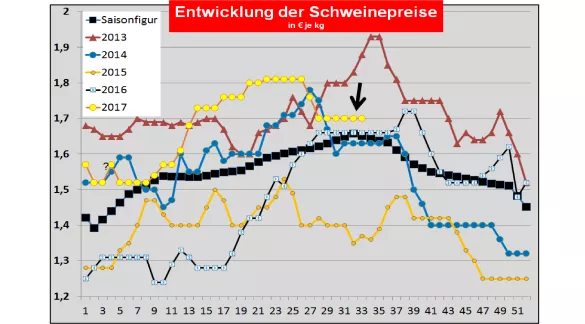

Pig prices for 33/34. KW-2017 The ISN Internet web site on Tue, 15 August 2017 provided an average profit of 1.76 € / kg for a range of 1.72 -1.77 € / kg. The offer was 3,330 pigs. There remained a supernate of 41%. General market and price trends: The sales business in the meat sector has improved slightly in some federal states, despite holidaying. The slaughter numbers and the battle weights remain below average. In Spain, the high price level reached (1.91 € / kg) leaves no room for maneuver. High slaughter figures in Italy slow down another price rise. In France, the supply-to-demand ratio remains balanced with slightly declining prices, taking into account the holiday.In the USA the price increase was only short-lived; For the conversion to € / kg, the prices are reduced to 1.40 € / kg. Brazilian pork prices have also stopped. Prices in China remain at a low level. Slight increases in own production and weak demand are the main causes. China's pork imports continue to decline. Denmark: Danish pork prices were published in the . KW-17 maintained unchanged The slaughter figures are -6.2% below the previous year's level.For the coming 34th KW-2017 the prices will be reduced by -2.7 ct / kg . In France / Brittany was The quotation (17.08.) U m -0.9 ct / kg is reduced .The reported slaughter figures for the whole of France are included 360,958 (previous week 356,062 last week 351,778) pieces continue in the lower midfield. The Dutch slaughter companies paid unchanged in the 33rd KW . In the 34th KW 2017. , , , , Ct / kg can be paid. (Addendum follows) Belgium: Pig prices were maintained unchanged in the 33rd KW . The quotations of the slaughter companies are for the 34th KW 2017 ....... Ct / kg. (Supplement follows) Germany : The slaughter numbers reach 967,639 (previous week 952,039 previous week 939.589) pieces. For the coming period from Thursday 17.08. Until Wednesday 23.08. (33/34 KW-17) the association price was 1.70 € per kg respectivelyIndex point repeatedly. The range ranges from 1.70 to 1.70 € / kg. The announced delivery volumes of the next week are again higher, with 226,100 (previous week 217,500 preceding 217,800), but still below average. The fattening pigs' basic fare in Austria was valid for the 32nd / KW remained unchanged. The pig offering falls only slightly on the basis of the holiday-related price, but the competition from Germany does not allow a price increase. For the 33rd / KW should be retained. The pork prices in Spain were on Thurs, 10.08. Remain unchanged.In (Upper) Italy pig prices are on 14.08. In Modena at -0.2 ct / kg , at Di in Reggio + -0.0 ct / kg and Cremona by +2.0 ct / kg .The slaughter figures are included 45,060 (previous week 39,575 last week 40,554 40,554) piece at the top Midfield. In Poland on 04.08.2017 pig prices at 57% MFL of 1.662 € / kg were quoted.Outlook: The hopes of improved meat demand remain low as a result of the holiday / holiday season, but has improved somewhat. In the southern holiday countries, demand remains buoyant, but the high price level reached has reached the highest levels. The local pre-registrations continue to point to rising slaughter numbers for the current week (1 million?). The US prices are at 16.08.To 1.45 € / kg . The stock exchanges in Chicago for later delivery dates in late summer and autumn Indicate a markedly downward tendency. In the autumn months prices are expected to reach 1.20 € / kg. The dollar, which is no longer quite so weak, is less powerful To the export business. The slaughter weights are again over 93 kg.China's pig pens Have joined 2,45 € / kg are on the 09.08. For the time being. We expect a more friendly business in the coming months, but the big moment is not to be expected. Chinese pork imports continue to be very restrained. The Russian pork prices are on 09.08.In 2017 remained at 1.95 € / kg . The ruble remained largely unchanged. The increase in domestic supply leads to a self-sufficiency rate of 95%. The current pork demand is at the same level as 3 years ago. In the foreseeable future, Russian pigmeat exports will become necessary for market relief. Brazilian pork prices are based on the average values in the southwest region on 14.08. stopped at 1.40 € / kg.decreasing Domestic prices and a weak real contributed to the result.

ZMP Live Expert Opinion

The two-part EU market will become visible in an unusual price reduction in Denmark and still small price increases in Italy. The majority of the countries are in between. Nevertheless, the price level still remains considerable at 1.70 € / kg. This is attributable to the restrained availability of livestock and - despite the decline - an above-average third-country business compared to previous years. The increased pre-registrations indicate higher slaughter numbers.