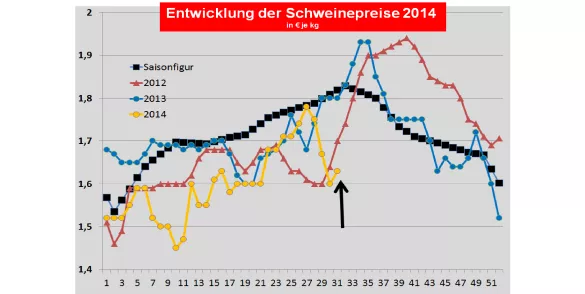

Higher pork prices for 30/31 KW (Thu, 24 Jul–26 Jul Wed, 30 July)

The ISN Internet stock exchange on Monday, July 21, 2014 has led to an average price of/1.65 €/ kg (+ 0.02 €/ kg) at a range of 1.63 to €1,685 / kg. The 2.935 offered pigs were not sold 3.06%.

General market and prices:

The battle figures persistent across Europe for weeks on a low level are for the weak sales of the meat still good demand opaque. Poor BBQ weather, holiday and start of your holiday, Annual closing in the processing industry and the persistently unsatisfactory third country export are the reasons for the previously weak sales business. Despite rising third-country exports to Japan, South Korea and Philippines the extent of the Russian import ban can not be counterbalanced by far.

Current market situation in major production areas:Denmark:Danish pig prices were in the 30 KW-withdrawn 2.7 ct / kg. The battle figures remain-2.6% behind the previous year's return. For the next 31 KW (24.07 to 30.07) the base price will remain unchanged in France/Brittany were small Monday market (21.07 14) -0.8 ct / kg paid in declining amounts of supply. At the Thursday market (17 July 14) were -0.3 ct / kg paid heavily increased supply. The reported battle figures in all over France are still too high for the industry.

The Dutch have battle company in the 30 KW - 3-8 ct/kg paid. The battle figures in the upper average. The prices for the 31 KW to + 2 to + 5 ct / kg higher.Belgium:Pork prices in the 30 KW were in good average offer amount -6 ct / kg reduced. The battle figures have attracted back to the below-average range levels of the previous week. Are the quotes of battle company of the 31 KW to + 2 ct / kg higher.

Germany: The reported battle figures in the last 6 weeks on average be rd. 925.000 piece below the 1 million PCs. brand. The previous year's level is not exceeded. But the meat sale falters. For the next period from Thursday to Wednesday 30 July 24 (30/31 KW) was the price of Association on €1.63 per kg or index point to + 3 ct / kg lifted. The range from 1.60 to €1,64 / kg. The announced delivery quantities of next week have fallen back on rd. 206.000 piece.

The applicable in Austria pigs base price for the 29/30 KW was- 6 ct / kg after corrected below. The listing for the upcoming 30/31 KW have been the pig prices in Spain unchanged (24 July 2014) are + 1.2 ct / kg has been enhanced.

In (upper), pork prices in the 30 KW wereItaly on Monday (21.07) in Milano + 1 ct / kg, in Modena to + 3.4 ct / kg paid.On Tuesday (22.07) was in Reggio Emilia + 3.6 ct / kg recorded, on Wednesday (23.07) i wasn Cremona + 3 ct / kg traded. The reported numbers of battle remain clearly attached back level.

The recent price surge is the result of previous price factors more favourable demand behavior, as well as better weather prospects for sales of barbecue products. A limited Lebendangebot due to heat weaker increases could provide further price pressures.

The US the Lean hogs Futures Quotes have reduced for the July/August on something more than €2 / kg. The recent US cold storage report showed inventories at the Schweinebäuchen to + 25%, while there were significant deficits in the other sections. Total cold storage stocks are about 20% below previous year's level. At the same time settle the beef courses at the level of €4,5 / kg mark. The poultry meat prices will benefit increasing offer volumes.

Chinese pork prices have consolidated at the level of just under €2 / kg. The courses but still below the multi-annual average of 2.30 to €2.50 / kg. The United States have provided significantly less pork to China. The Chinese destocking is 2014/15 expected a tighter range at the turn of the year.

Russian pork prices remain at levels above €3.0 / kg SG. Substitute imports range from not to blocked EU imports first. Until the recent time are more AFP cases have occurred in Russia and the Baltic States.

Brazilian pork prices remain unexpected for the season flying high in height of €1,60 / kg. Russian imports from Brazil have increased 21% in the first half of 2014 and reached a level of almost 70,000 tonnes. For Brazil, this is a high price, for Russia's by far not enough to compensate for the suspended EU deliveries.

ZMP Live Expert Opinion

The increase of in pork prices in Europe points to a recovery of in demand. Despite vacation - and holiday-related throttled domestic consumption, a more moderate price increases can not be excluded. BBQ weather on the one hand and temperature due to lower Lebendzunahmen with the result a restrained supply the drivers could be. The expectation of rising third-country exports keep within limits. Japan, South Korea and the Philippines are hopes for increasing exports on a limited scale. Declining U.S. supplies encourage the EU export.

In the United States, an overcoming of PEDv-related failures of the battle seems to initiate. The courses give slightly, but remain considerably high level of rd €2 / kg.