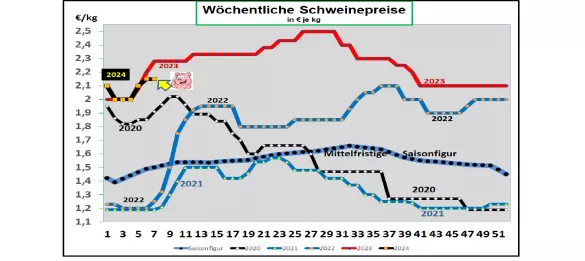

Germany: V price 2.15 €/ kg (range 2.15 – 2.20 €/kg) The weekly slaughter numbers were lower again at 708,735 pigs (previous week 728,719 ), and the slaughter weights rose slightly to 97.5 kg . Pre-registrations remained largely unchanged at 246,500 pigs (previous week 245,000) . The ISN auction on Tue, February 20th 2024 brought an average of €2.30/kg in a range of €2.26 – €2.32/kg. The V-Prize is for the period from February 22nd, 2024 to February 28th. 2024 has been set at 2.15 €/kg in a range of 2.15 - 2.20 €/kg. ASF : As of February 16, 2024, 5,660 ASF-infected wild boars have been officially confirmed in Brandenburg, Saxony and Mecklenburg. In January 2024, 13 ASF cases were reported, exclusively in the Dresden district. Market and price development in selected competing countries: In Denmark , the comparable prices were increased by +4 ct /kg to €1.78/ kg in the 8th week of 2024. In Belgium in the 08. In week 2024, the comparable calculated prices of €2.03/kg have been increased by +2 ct/kg. In the Netherlands, the quotations will be increased by 4 ct/kg in the 8th week of 2024 with comparable calculated prices of €2.04/kg . In France/Brittany prices rose by +6 ct/kg to €1.857/ kg . The number of slaughtered pigs fell back to 354,229 pigs with a slaughter weight of 96.48 kg. In Italy, the prices fell slightly by -0.5 ct/kg in the 8th week of 2024. The offer currently more than meets needs. In Spain, prices will be increased by +4 ct/kg in the 8th week of 2024 with a comparable €2.20/kg . The life supply is becoming increasingly smaller. In the USA/IOWA, the explosive rise in producer prices continues to the current €1.42/kg . The battle numbers continue to fall. The unit prices are rising significantly. The futures prices on the Chicago Stock Exchange for the delivery month April-24 are already at €1.74/kg. Brazil: Producer prices have remained on average at €1.60/kg . The month of February shows weak domestic sales; slight support comes from export business. However, increasing sales figures and high prices are expected for 2024. China: Prices fell to €2.30/kg after the New Year holiday week. Experience has shown that the sales and price slump lasts for a long time. Prices of €2.46/kg will only be traded on the Dalian stock exchange for the month of May 2024; the July 24 date is €2.76/kg. Domestic production is expected to be smaller in 2024. Conclusion: In most EU countries, pig prices have followed the guidelines from Germany with rising prices. Low slaughter numbers, smaller pre-registrations, low cold storage stocks and more lively demand tend to drive up pig prices. For the time being, this development of supply and demand will continue to a limited extent.

ZMP Live Expert Opinion

The scarce life supply continues. In view of more lively demand and increasing stockpiling for the grilling season, the supply situation remains tight. However, the already high price level is slowing any major increases for the time being.