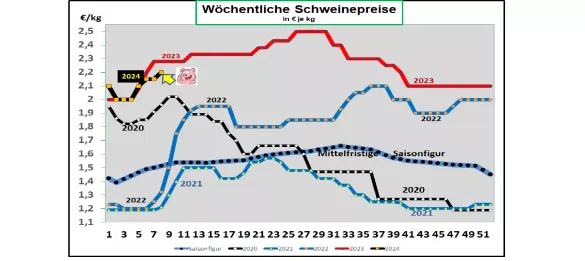

Germany: V price 2.20 €/ kg (range 2.15 – 2.20 €/kg) The weekly slaughter numbers were slightly higher again at 728,675 pigs (previous week 708,735 ), and the slaughter weights increased slightly to 97.6 kg . Pre-registrations were still low at 245,800 pigs (previous week 246,500) . The live supply remains scarce. The ISN auction on Tue, February 27th 2024 brought an average of €2.29/kg in a range of €2.27 – €2.32/kg. The V-Prize is for the period from February 29th, 2024 to March 6th. 2024 has been set at 2.20 €/kg in a range of 2.15 - 2.20 €/kg. ASF : As of February 16, 2024, 5,660 ASF-infected wild boars have been detected in Brandenburg, Saxony and Mecklenburg. In January 2024, 13 ASF cases were reported in the Dresden district. Market and price development in selected competitor countries: In Denmark , the comparable prices remained unchanged at €1.78/kg in the 9th week of 2024. In Belgium, the comparable prices of €2.03/kg also remained unchanged in the 9th week of 2024. In the Netherlands , the quotations will continue unchanged in the 9th week of 2024 with comparable prices of €2.04/kg . In France/Brittany prices rose again by +6 ct/kg to €1.917/kg . The number of pigs slaughtered has fallen further to 351,604 pigs with a slaughter weight of 96.53 kg. In Italy, the prices were raised again by +0.5 ct/kg in the 9th week of 2024. The supply remains limited with subdued demand. In Spain, prices will be increased by a further +4 ct/kg in the 9th week of 2024 to a comparable €2.24/kg . The live supply is relatively scarce with limited sales opportunities. In the USA/IOWA, the rapid rise in producer prices continues to the current €1.47/kg (+5ct/kg). The slaughter numbers have increased slightly, but demand remains high. Partial prices are mostly increasing. The futures prices on the Chicago Stock Exchange for the delivery month April-24 are already at €1.76/kg. The summer months trade even higher. Brazil: Producer prices have fallen on average to €1.55/kg . The month of February shows weak domestic sales; support from export business is still low. However, increasing sales figures and high prices are expected for 2024. China: Prices have recovered to €2.69/kg after a brief price decline. Weak demand is usually expected for the next few weeks and months. The month of May-2024 is trading at 2.52 €/kg on the Dalian Stock Exchange; the July 24 date is €2.70/kg. Domestic production is expected to be lower in 2024. The number of sows has fallen. Conclusion: In most EU countries, pig prices have so far followed the guidelines from Germany. Low slaughter numbers, smaller pre-registrations, low cold storage stocks and stable demand are keeping pig prices at a rising level.

ZMP Live Expert Opinion

A predominantly scarce supply of live food leads to rising prices due to good demand, low cold storage stocks and increasing stocks for the grilling season. Germany plays a pioneering role in the EU internal market, which other countries are gradually joining. The upward price scope has not yet been exhausted.