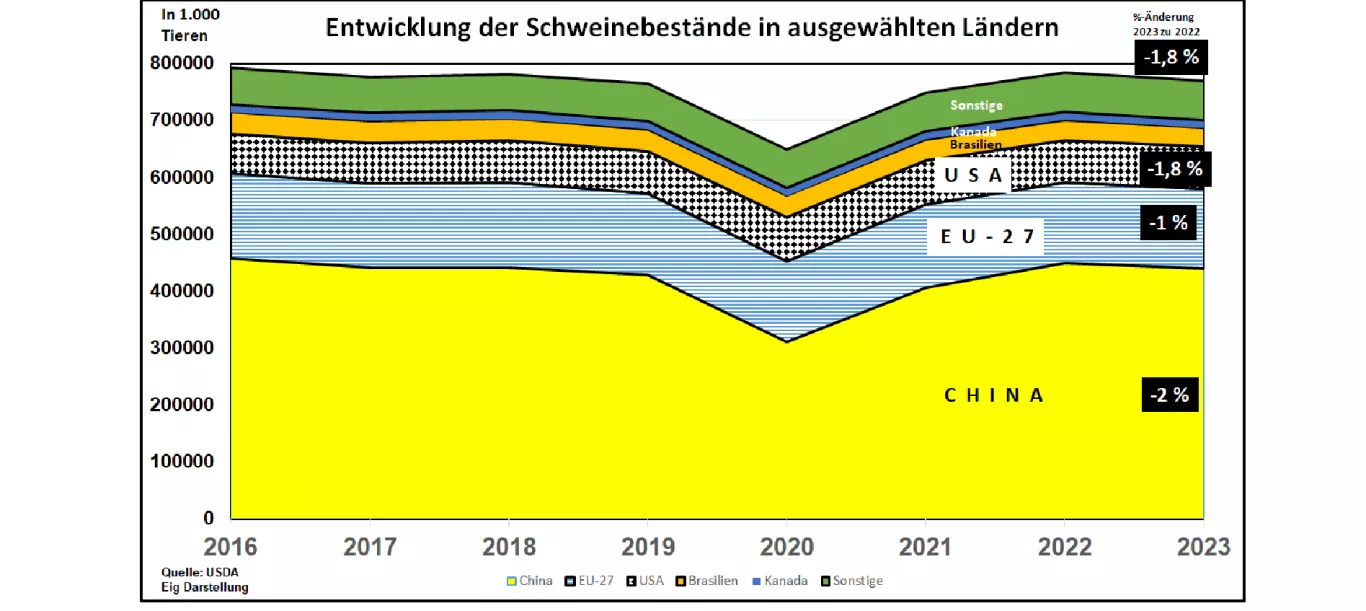

Growth in global pig population halted for the time being. After the ASF-related herd slump in China, global pig numbers have recovered to pre-ASF levels in 2022. For 2023, however, the US Department of Agriculture (USDA) estimates a slight decline of around 1.8% compared to the previous year. In the largest production area , China , with more than 50% of the world's pig population, a politically supported reduction is being introduced on a moderate scale for the first time after a rapid reconstruction phase. The control is based on a specified benchmark for the maximum number of sows. This is intended to achieve market and price stabilization in order to enable adequate cost recovery. The shortage of pork is covered by cheap imports at two thirds of the domestic price. In the world's second largest production area , the EU-27, pig numbers have been falling since 2021. The background is the after-effects of the Covid pandemic, ASF-related export restrictions, increased feed and energy costs, restrained demand for meat due to inflation and changes in animal husbandry conditions that slow down investments.Compared to 2023 to 2021, a 3.5% decrease in stocks can be observed. The increased supply shortage already led to above-average prices at the beginning of 2023. Clear differences can be observed in the individual EU Member States. In the USA , as the third largest pig farmer at world level, there has also been a population decline of just over 5% since 2021. Initially, the Covid pandemic caused significant restrictions and turbulence, particularly in the area of slaughter and processing. In the further course, the increased feed and energy costs caused long-lasting losses for the producers. The inflation-related restraint in demand from Germany and abroad has recently left clear signs of the slowdown. US prices have now fallen to such an extent that the international competitiveness that has been gained promises more export opportunities for the rest of 2023. In principle, Brazil's pig farming remains on course for growth, even if the pace is currently much slower.Several southeastern provinces are among the world's lowest cost generation locations. Currently falling feed prices are improving the chances of success. The driving force is increasing exports to China, South Korea and the Philippines. However, Brazilian domestic demand is being dampened by higher consumer prices. Canada's export-oriented pig farming, with around 70% exports, has been stagnating for years. Recently, the increased production costs have led to a moderate destocking.