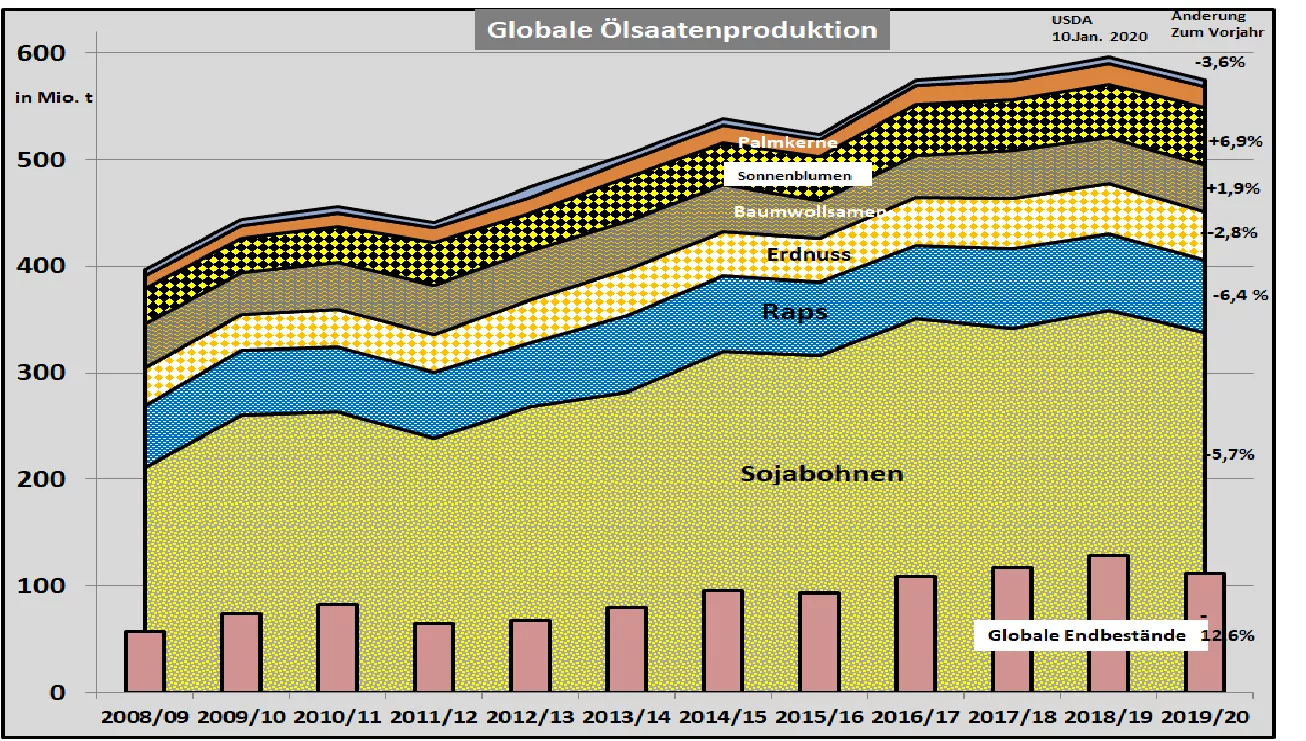

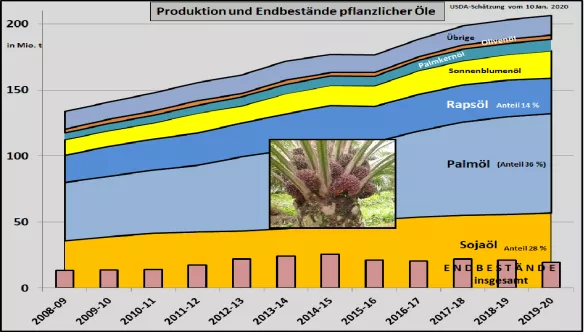

USDA Jan 2020 report: Oilseeds 2019/20 still below the previous year's level - less soy, even less rapeseed, moderate growth in palm oil, increasing sunflower seed. In its January 2020 issue, the U.S. Department of Agriculture (USDA) estimates global oilseed production as unchanged from the previous month at 574 Mt. The result remains with approx. 22 million t or 3.7% below the previous year's level. However, consumption rose by 7 million t to 496.5 million t. The final stocks drop by 16 million t to 112 million t. This means that there is still an above-average stockpile worldwide. The decline in soybean production is primarily due to the US crop reduction from 120 million t last year to 96.8 million t this year. The causes are the unfavorable cultivation and harvest conditions in 2019. In contrast, in spring 2020 a record soybean harvest will be achieved in Brazil with 123 million t .In Argentina , however, only a below-average result of 53 million tons is to be achieved. The new Argentine export taxes may still have an impact. On the consumption side , the USDA assumes a slightly increased 303.5 million tons of soy. In China, consumption remains at just under 85 million tons. The EU remains unchanged with imports of 15 million tons. Slight increases can be observed in other smaller consumption areas. The final stock of soybeans decreased from 110 in the previous year to an average of 96.6 million t in the current year. The global rapeseed harvest fell from a low 72 million t last year to 67.7 million t this year . The decline is primarily due to the extremely weak EU harvest of only 17 million t and to Canada with only 19 million t . India and China are also experiencing slight redemptions, which they compensate for with increasing imports. The USDA estimates rapeseed consumption at 69.1 million.t with the result that inventories will be reduced from 8.3 to 6. million tons in the current marketing year. Compared to previous years, inventories remain just above average because Canada has remained stuck on unsold goods due to the Chinese import ban. Palm oil production is cut again compared to the Dec. 19 estimate and comes to just over 72.5 million t. only a little higher than last year. The main reason is the little changed results in Malaysia with 20.5 million tons . Indonesia , too, has annual growth of +2 million t behind the usual increases. The USDA increased palm oil consumption slightly to 74.7 million tonnes in the previous month. Increased exports to India and China and an increase in the proportion of diesel admixtures in Indonesia are the key drivers. The final stocks decrease by 10%.The soy prices on the Chicago Stock Exchange have stopped their downward trend and are pointing upwards. The prices for palm oil have again increased strongly, with a special focus on the delivery month of May with +10%. The relapse of the past few weeks has almost been caught up.