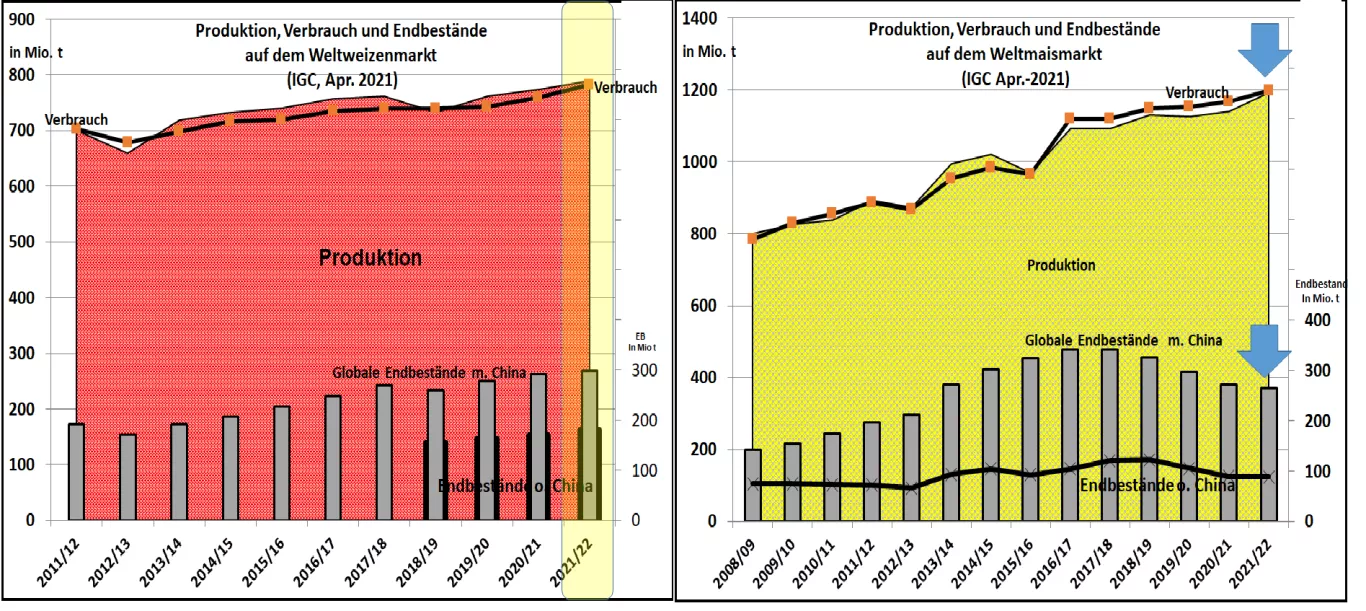

IGC: World grain harvest in 2021/22 2.8% higher than in the previous year - supply remains scarce In its April 2021 edition, the International Grain Council (IGC) estimates the global grain harvest little changed compared to the previous month, 2.8% higher to 2.287 million. t compared to the previous year. Consumption is estimated at 2,286 million t . This means that the overhang stocks remain largely unchanged at 609 million t. The supply figure falls for the 5th time in a row to 26.6% of the final inventory for consumption . This could mean that the current international price level could continue on average for the coming grain year. However, there are still a number of market risks to be overcome on the supply and demand side. In the wheat sector , a record harvest of 790 million t or +2.1% compared to the previous year is still forecast. At 782 million tons, however, consumption is estimated to be higher than in March.This results in a low inventory build-up from 292 to 298 million t. The supply figure is calculated on a slightly reduced 38% final inventory for consumption. This means that the wheat market in and of itself is still well supplied. But there are still critical questions about wintered US wheat stocks and delayed US spring wheat sowing. Risks also have to be considered with regard to income. The renewed soaring of wheat prices on the stock exchanges to over € 225 / t has already been slowed down. Most of the still unordered maize is expected to deliver a global harvest of 1,192 million tonnes, or +4.6 % compared to the previous year. The high expectations of a price-related expansion of space in the USA as the world's largest producer and exporter are being dampened by the cold spell and drought. However, at 1,199 million tons, consumption is expected to be somewhat lower than estimated in the previous month. Accordingly, inventories in the course of corn marketing year 2021/22 be by approx. 7 million to 264 million tt degraded. The supply figure falls to a low 22% final inventory to consumption compared to previous years up to 30%. Overall , it can be observed that despite increases in production, no improvement in the supply situation is foreseen. This trend has been evident for 5 years in a row. The background to this is the more rapidly increasing consumption. Above all, the unusually strong increase in imports from China plays a decisive role here. Chinese imports have more than quintupled in the past 3 years.